Our Real Estate Investment Fund Offerings

A World of Opportunity

Whether investing capital or contributing property, our core focus is working toward preserving our investors’ wealth and producing tax-efficient income and appreciation over time. Details about our Private Real Estate Funds and the Legacy Fund can be found below.

Our Investment Options

We offer multiple ways to invest in private real estate. These options are inclusive of our finite Private Fund structure, the evergreen Legacy Fund structure and custom managed accounts.

MLG Private Funds

With an investor-centric fund structure, accredited investors can invest in a real estate fund that targets asset category and geographic diversification, prioritized cash flow, and low-to-moderate leverage with a unique dual-sourcing strategy.

Potential Benefits

-

Asset & Geographic Diversification

-

Low Market Correlation

-

Cash Fl;ow

-

Structure Options

MLG Legacy Funds

This fund is specifically designed for investors to contribute property. The asset you own is unique, and we have the expertise to help guide you through the complexities of exiting ownership.

Potential Benefits

-

Passive Ownership

-

Asset & Geographic Diversification

-

Tax Efficiencies

- Icon List Item

Managed Accounts

Our approach is focused first on capital preservation, followed by income and appreciation to enhance after-tax returns.

Potential Benefits

-

101 Exchange Experts

-

Family Office Partnership

Potential Benefits of Private Real Estate Investment Funds

Private real estate investment funds offer a unique opportunity for investors to diversify their traditional portfolios while benefiting from the potential for stable income and long-term appreciation. These funds provide access to exclusive real estate investment opportunities that may not be available through traditional channels, allowing investors to leverage our expert management.

Strategic Selection of Properties for Real Estate Investment Funds

Our deal sourcing, analyst teams and investment committee thoroughly scrutinize deals using our proprietary review process, narrowing them down to the best available opportunities. We focus on deals that we believe to be the most likely to perform best for our investors. These decisions are influenced by our institutional knowledge and market research data. Learn more about our acquisition strategy.

High Quality Investment Reporting

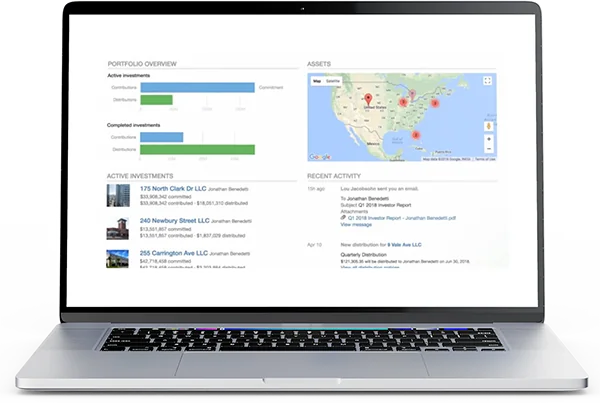

We combine the strength of our reporting with an online investor portal for 24/7 access, so you can quickly find answers to simple questions. And our skilled, concierge-level staff is readily available for deeper conversations.

Investor Portal

Comprehensive reporting including fund distributions

Tax Form Reporting

Quarterly Reporting

Property Updates

Get Started

Let’s Begin

Embark on your private real estate investment journey today.

Learn More

Take some time and dive into the details about private real estate on the MLG Capital blog.

1. As of 12/31/2025

2. As of 12/31/2025, for determination of Market Value, sold properties are valued at actual sales price. Active and pending investments are based on MLG’s estimate of current value. Recent acquisitions are generally valued at the acquisition price.

3. As of 12/31/2025, Square Feet includes multifamily properties.