Partnering with MLG Capital for Your Real Estate Assets

If you have a deal for a multifamily, industrial, retail or office asset and seek to either sell, contribute to the Legacy Fund, or partner with us through joint venture – we want to learn more about your property.

Conventional Asset Acquisition

MLG invests in a variety of real estate asset classes including multifamily, industrial, retail and office. The properties we seek include value-add opportunities as well as undervalued deals or opportunistic investments.

Investment Criteria

Total Capitalization

$10 ‒ $100M

Target Hold

2 ‒ 10 Years

Total Capitalization

$10 ‒ $100M

Target Hold

2 ‒ 10 Years

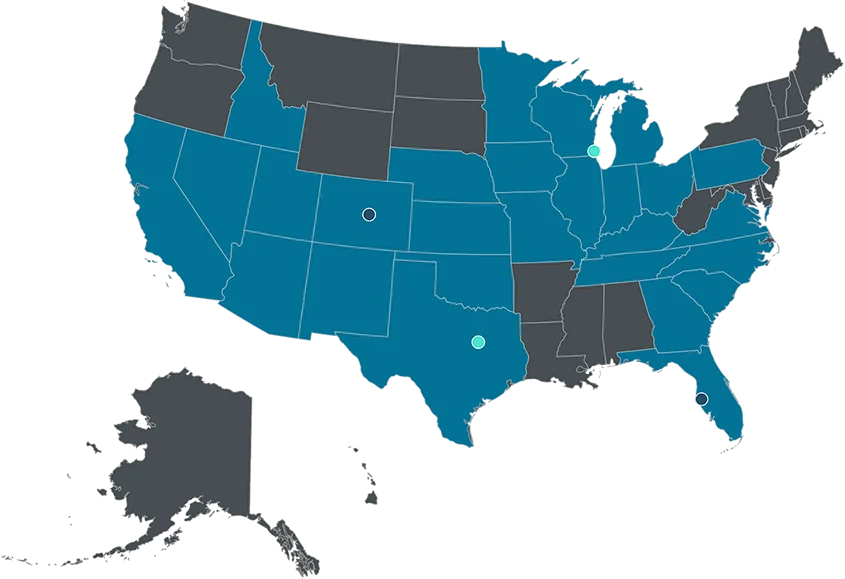

Targeted Markets of Acquisition

Wisconsin Headquarters

Located in Brookfield, a suburb of Milwaukee, Wisconsin, in a repurposed grocery store, our roots are grounded in grit and determination you can only find in southeast Wisconsin. That’s what sets us apart from anyone else in private real estate.

Denver

Soon to open late Q1 2024, we now have dedicated, local feet on the ground to assist with acquisitions and investor relations in Colorado and the Mountain West United States.

Dallas

Located at the heart of a strong real estate market, our office in Dallas serves as our hub for acquisitions in the Sun Belt.

Sarasota

Our office in Sarasota not only provides convenient access to getaways from northern winters, but also provides us an opportunity to have feet on the ground in one of America’s fastest growing states.

- Offices

- Satellite Offices

- Target Markets

Criteria by Asset Type

We target assets across multiple geographic markets and classes. Our investment strategy focuses on finding unique real estate acquisition opportunities, primarily in the five asset classes listed below.

*The criteria outlined below are for properties MLG Capital considers for acquisition by the Fund and are not related to the performance of the Fund itself.

Multifamily Assets

A- to B Classes

Value-add Class A- to B Investments

Renovate individual apartment units, amenities and common areas so rental rates and value can be increased. Properties over 200 units are preferred.

Criteria

-

Built

1980’s+ with strong preferences for 2000’s+ -

Units

200+

A Class

Under-Valued Class A Deals

Target newer construction properties priced below replacement cost at an attractive basis. Our goal is to increase property performance to create income or value appreciation..

Criteria

-

Focus

Solid Demographic and Submarket Metrics -

Seeking

Loan Assumptions and Equity Recaps

Industrial and Flex

Value-add Class B and C Assets

Undervalued or under-occupied/strong locations that provide opportunities for creating value through additional leasing, raising below market rent, or at attractive pricing.

Criteria

-

Built

1970s+ -

Square Footage

100,000+ -

Layouts

Multi-Tenant

Office and Retail

Unique Opportunities

MLG approaches office and retail property types with a merchant mindset. We seek assets generally used for staff workplace and corporate settings, or used for shopping and entertainment. We view these real estate assets though an opportunistic lens, where well-located properties can be improved by fixing a problem and exited upon completion.

Criteria

-

Built

1970’s+ -

Hold Period

Approx. 2-4 Years -

Seeking

Opportunistic with Higher IRR Target (18%+)

Ways to Work With Us

Joint Venture with MLG

Our strategy is focused on real estate in positive economic markets with job and population growth. We’ve accumulated numerous contacts from across the nation from which we seek opportunities and partnerships. Generally, we target 8% cash-on-cash and a 90% MLG / 10% sponsor equity split, but are open to other options. Download our Joint Venture Brief.

Direct Acquisitions

We target multiple asset classes for direct purchase, including in states where we are located, or a state where we have long-established relationships.

Legacy Fund

The Legacy Fund was specifically designed to provide owners of commercial real estate the option to dispose of their property while potentially benefiting from an investment in a professionally managed, diversified real estate fund. Owners may contribute their property via a tax deferred transaction in exchange for units in the fund. Additional benefits are explained below.

1031 Exchanges and Managed Accounts

Our approach is focused first on capital preservation, followed by income and appreciation to enhance after-tax returns.

I have a Property for Sale

At MLG, we’re looking to purchase commercial multi-family, industrial, retail and office assets. We are not seeking single-family homes.

I’d like to Start a Joint Venture

We are always looking for investment opportunities, especially from sponsors who are experts in a given market.