“Smart Real Estate Investments:” At MLG this is more than just a phrase. To us, Smart Real Estate Investments is all we do. We study the economics of real estate to understand current metrics, past trends, and future projections affords the opportunity to capitalize on unique opportunities and in doing so provide exceptional returns to our investors. – Tim J. Wallen

We are excited to present our Q3 2023 Economic Outlook. Our team at MLG has collaborated to create a comprehensive presentation that highlights our perspectives on the real estate investing landscape as we look forward to another year of profitable investing.

You can watch the full presentation above, or continue reading for a summary below.

Summary

The Q3 2023 Economic Outlook delves deep into the economics of supply and demand in real estate. Supply and demand are the focal points of basic economic theory, depicting how changes in the price and availability of a resource impact its value as an investment both now and in the future. Understanding the factors that drive supply and demand is imperative in the analysis and decision-making process for every potential acquisition.

Below we’ll address three key questions closely related to supply and demand which summarize our perspective on real estate investing in 2023.

Key Questions

- Are real estate investments attractive in this market?

- What key statistics are we seeing in the market today?

- What’s your perspective on multifamily investing?

Are real estate investments attractive in this market?

At MLG we believe in buying through all cycles. It’s difficult to time the market’s rise and fall, and there’s rarely ever a ‘perfect’ time to be investing or divesting, but we believe that appealing investment opportunities can always be found in any market. In the current market, we’re finding opportunities due to human error, less buy-side competition, and through disciplined underwriting.

Human errors present themselves in many different ways. Whether it be poor asset management, missed opportunities, or selling off market, our team consistently capitalizes on these instances.

We’re also seeing a dramatic decrease in competition on the buy-side of the market. This is likely due to many institutional investors reallocating liquidity to bonds instead of real estate and also due to the reduction in debt availability.

Ultimately, disciplined underwriting helps us uncover investment opportunities with significant potential. In our underwriting process, we prioritize reducing risk. To do so, we are assuming in all of our underwriting that interest rates will remain the same throughout the entire hold period. If interest rates come down, these assets will prove to be much more profitable investments than we originally anticipated.

What key statistics are we seeing in the market today?

Rent Growth

Our views on rent growth are positioned in the belief that rent growth will level back out to historical averages in the coming years. The growth rates seen in the past few years were not sustainable, and we cannot expect them to continue going forward.

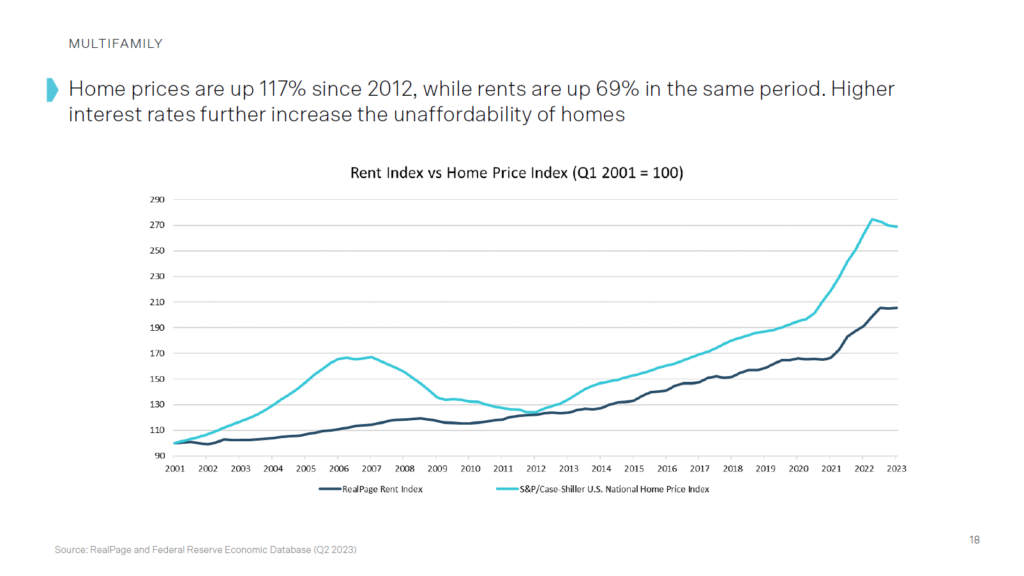

Despite this, rents have only grown 69% over the past 20 years while the price of a single-family home has grown 117%! This dramatic imbalance will continue to create demand for multifamily housing as a more affordable alternative to buying a home and even presents the argument that rents still have room to grow to catch up to single family home prices.

Construction Costs

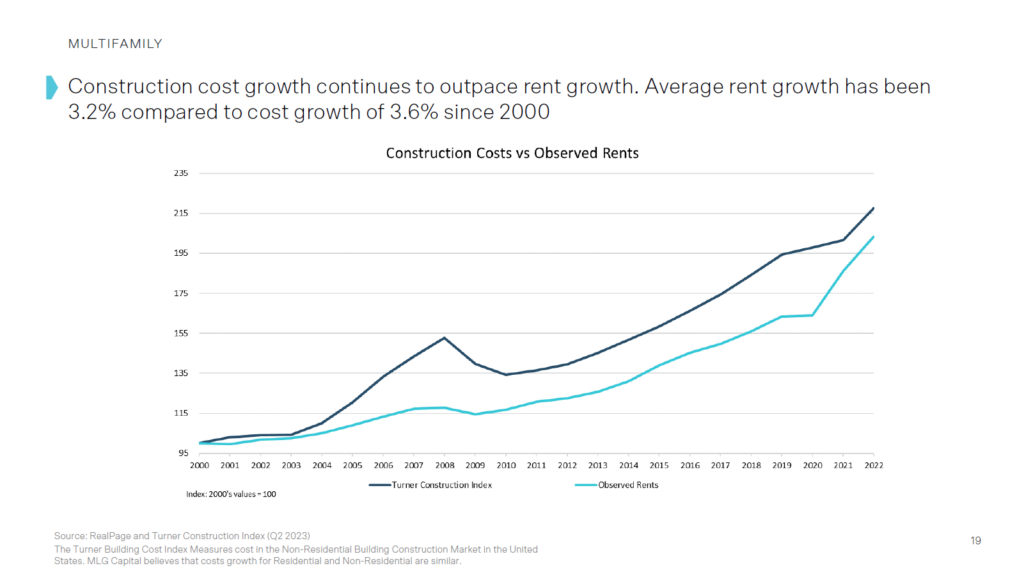

Similar to the cost of single-family homes, construction costs for multifamily properties have consistently surpassed rent growth over the last two decades. This hints at the fact that the profit margin for developers is likely shrinking, especially with the high cost of debt we currently have.

The bottom line here is that we believe developers aren’t going to build new product if they can’t get returns that justify the cost to build, furthering the standpoint that rents may still have room to grow.

What’s MLG’s opinion on Multifamily investing?

Human error is an inherent part of any business and industry, and real estate is no exception. It’s a fractured and fragmented space that always presents opportunity for those willing to dig for them.

We embrace the concept of investing in the current market, particularly during periods of higher interest rates. By underwriting our investments with the assumption that interest rates will remain unchanged throughout the holding period, we position ourselves to reap additional value above our targeted returns if rates eventually decrease.

Looking into the near future, we plan to focus specifically on Class A assets with a temporary supply disruption story.

Temporary supply disruption is an excess supply in a specific market that we anticipate will be absorbed quickly in the coming years. These circumstances will likely provide us with the opportunity to buy late 2010s products at a significant discount to replacement cost. We can then hold onto that asset during a period of excess supply, and ultimately sell it when demand returns to the market.

For more information or to learn more about ways to invest, connect with us or click the link below to download the PDF version of the presentation.

The author, MLG Capital, its representatives, employees, officer, directors, members, respective partners, agents and its affiliates (“MLG”) do not represent any recipients of this article (“Recipients”) and all statements made by MLG shall not be considered tax or legal advice. Recipients shall consult with their own tax or legal professional regarding their personal financial and tax situation and its relation to the information presented in this article. This article does not constitute an offer or solicitation in any state or other jurisdiction to subscribe for or purchase limited partnership interests in an offering. An investment into a private offering is subject to various risks, none of which are described herein. Recipients of this article agree that MLG shall have no liability for any misstatement or omission of fact or for any opinion expressed herein.