For accredited investors looking to expand beyond traditional stocks and bonds, private real estate funds have become an increasingly attractive option. These funds have the potential to provide access to professionally managed, income-generating properties, while potentially providing diversification, stability, and tax benefits.

At MLG Capital, we’ve spent over 38 years helping investors grow and protect their wealth through private real estate. Below, we explore the key reasons why this asset class has become a cornerstone in many sophisticated portfolios.

Why Invest in Private Real Estate Funds

Greater Diversification Supports Investment Stability

One of the most compelling benefits of private real estate funds is the ability to diversify in ways that individual investors often cannot achieve on their own. MLG Capital’s funds invest across multiple property types and regions throughout the United States.

Geographic diversification reduces exposure to localized economic challenges. What’s happening in one city or state does not dictate the performance of the entire portfolio. Meanwhile, asset type diversification (across multifamily, industrial, retail, and office properties) helps balance sector-specific risks. When one asset class softens, another may remain stable or even grow.

Enhancing Portfolio Resilience

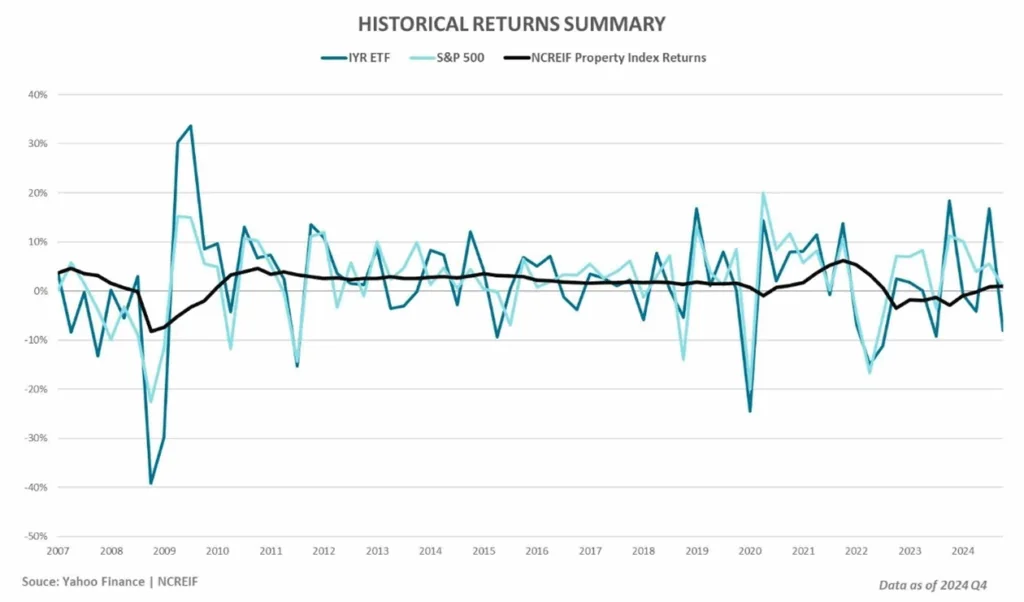

Investing in alternatives like real estate introduces an asset class that has traditionally had a low correlation to the public markets like stocks and bonds, offering diversification and the potential for greater portfolio stability. Unlike equities, which can experience sharp swings based on market sentiment, private real estate tends to be less reactive to daily headlines, providing a degree of insulation from short-term volatility.

At MLG, we focus on acquiring and managing properties that support both current income and future growth, allowing investors to benefit from both stability and opportunity.

Creating Opportunities for Potential Long-Term Wealth Growth

While consistent income is a cornerstone of private real estate investing, it’s the long-term growth potential that often makes it so powerful. Properties can appreciate in value over time due to strong market fundamentals, thoughtful capital improvements, and effective asset and property management. MLG brings experience and discipline to its investing approach and strategic capital improvement plans.

In addition, the reinvestment of cash flow and profits, either through fund structures or subsequent investment opportunities, can lead to compounded growth. For investors with a long term outlook, private real estate funds can support a strategy focused on accumulating wealth over time.

Inflation Protection Through Real Estate

Historically, real estate has served as a potential hedge against inflation. As the cost of living rises, rental income and property values often increase as well, helping investors maintain purchasing power and preserve real returns. This dynamic may make real estate a valuable addition to a portfolio, particularly during inflationary periods.

Structuring for Tax Efficiency

Generating returns is just one part of the equation. Real estate’s tax efficiency can make a meaningful difference in what you actually keep. One of the most often overlooked benefits of real estate investing is its favorable treatment under the United States tax code, something private real estate funds are well-positioned to take advantage of.

Through depreciation, investors can reduce their taxable income using a non-cash expense that accounts for the natural wear and tear of a property. Additionally, many private real estate funds, including those at MLG, use cost segregation studies to accelerate the benefits of depreciation. This strategy front-loads more of those deductions into the early years of ownership, often creating passive losses on paper, even while the investor is receiving cash distributions. These passive losses may offset other forms of passive income, enhancing overall tax efficiency.

In addition to income shielding, real estate can also offer favorable tax treatment upon sale. Gains from appreciated property may qualify for long-term capital gains tax rates, which are lower than ordinary income tax rates.

At MLG Capital, we intentionally structure our funds to take advantage of the tax benefits available to private real estate investors. Our focus on tax-efficient investing helps investors not only grow their wealth—but keep more of it. We encourage individuals to consult their own tax professionals about these tax strategies and how they could potentially benefit from them.

A Strategic Way to Invest in Private Real Estate

Private real estate funds offer a strategic way to build income, preserve capital, and create long-term value. Through diversification, lower volatility, and thoughtful tax strategies, they can serve as a complement to a traditional investment portfolio.

At MLG Capital, our funds are designed to reflect decades of experience, industry insight, and a commitment to putting investors first. We handle the complexities of real estate investing so you don’t have to.

Interested in learning how private real estate can enhance your investment strategy?

Connect with our team to explore current opportunities and discover how MLG Capital can help you grow your wealth through strategic, professionally managed real estate.

Understanding the Risks of Private Investments: What You Need to Know

Investing in private offerings, like our Fund, Legacy Fund, Co-Investment, or 1031 Exchange Program, comes with its share of risks and uncertainties. While we can’t cover every potential risk here, it’s important to be aware that the real estate industry is influenced by many factors. These include market fluctuations, operational challenges, interest rate changes, occupancy levels, inflation, natural disasters, capitalization rates, regulatory shifts, and tax considerations. Some of these risks may not even be identifiable at this time and could lead to outcomes different from expectations.

Disclaimer

Securities offered through North Capital Private Securities, Member FINRA/SIPC. Its Form CRS may be found here and its BrokerCheck profile may be found here. NCPS does not make investment recommendations and no communication, through this website or in any other medium, should be construed as a recommendation for any security offered on or off this investment platform.

This article is intended solely for accredited investors. Investments in private offerings are speculative, illiquid, and may result in a complete loss of capital. Past performance is not indicative of future results. Prospective investors should conduct their own due diligence and are encouraged to consult with a financial advisor, attorney, accountant, and any other professional that can help them to understand and assess the risks associated with any investment opportunity.

This offering includes risks and uncertainty many of which are not outlined herein including, without limitation, risks involved in the real estate industry such as market, operational, interest rate, occupancy, inflationary, natural disasters, capitalization rate, regulatory, tax and other risks which may or may not be able to be identified at this time and may result in actual results differing from expected. Advisory services offered through MLG Fund Manager LLC, an investment adviser registered with U.S. Securities & Exchange Commission.