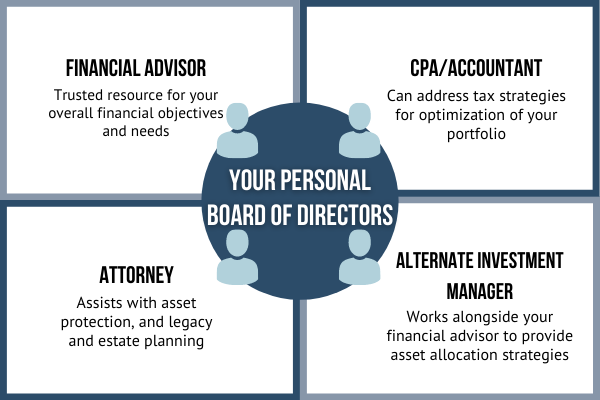

Wealth preservation is more than a one-person job; the advice of a diverse set of resources play an important role in creating and executing your overall wealth preservation strategy. While we’ve got real estate investment covered at MLG Capital, some of our best advice for wealth preservation is to build your own personal board of directors!

Understanding the roles of those that can serve on your personal board of directors is a key starting point. Let’s review some of the most widely used types of folks that could add value to you in your life goals.

Advisors: Who “runs” your money? Do you have a trusted resource to help you execute your overall financial objectives? Do you have an asset allocation strategy to ensure you’re aligned for different market cycles, cash flow needs, and a plan to manage through economic cycles? A financial advisor can provide material input when structuring your overall financial plan. Tips, tricks, and analysis on market allocation strategies merit a key seat on your personal board of directors.

CPAs: There are a slew of considerations when addressing your overall tax strategies. For example, when establishing a wealth preservation plan, you’d likely want to ensure you’re operating as efficiently as possible when it comes to Uncle Sam. How can legislative changes impact your current strategies? Realizing the tax benefits of certain types of investments, or correctly allocating strategies within estate planning can be an impactful tool, especially in alternative type investment structures where there can be certain tax planning benefits. Understanding and acknowledging the role of an experienced CPA is a must have on your personal board of directors.

Attorneys: How is the wealth you’ve accumulated going to live beyond your time on Earth? What structures or planning methods can help ensure a successful transition of wealth from one generation to another? How do you review opportunities presented to you and protect your personal interests? Do you have philanthropic goals, or are working to have a financial impact with a non-profit? Work with an attorney to answer some of these questions.

On top of having a great attorney sitting in one of your personal board seats, it can be impactful to have a close relationship between your attorney and your CPA. This relationship can be helpful for owners of appreciated real estate assets where planning can become ever complex, such as considering contributing property to the Legacy Fund.

Alternative Investment Managers: One of the most important roles at your personal board of directors table is having trusted alternative investment managers. If you’re not an industry veteran in private real estate, for example, how do you gain access to the industry and ensure success? Experience, trust, dedication, and investor-centric business structures are key considerations when allocating funds within alternatives to ensure you’re making the best potential allocation available.

As accredited, high net worth investors, you should consider the importance of capitalizing on the specialized knowledge brought by others, as you progress in your endeavors of building generational wealth, and preserving said wealth. After all, surrounding yourself with smart, knowledgeable people can materially change an outcome. When thinking of your current business or career, you rely on others in almost every aspect of what you do. Why not take the same approach when it comes to your financial strategy? Build a mosaic of good advice and prudent planning that can be seamlessly executed.

MLG Capital is more than happy to leverage 34+ years of existing relationships and provide references for seats at the table of your personal board of directors. In addition, we are more than happy to have a conversation with your personal advisors to see if our strategies fit within your objectives both in the near term, and long term, as well as bring expertise to the table in planning. Invest with us today.

David Binder Jr. is Senior Vice President at MLG Capital. He oversees capital sourcing operations, sales technologies, company marketing and investor relations operations. He joined MLG in 2014 to help the company launch its Fund series and previously held various positions with Wells Fargo, Wells Fargo Advantage Funds and a correspondent lending company. He has a bachelor’s degree in marketing with an emphasis on real estate. He is passionate about always digging deeper by asking “Why?”, seeing folks succeed in life and surrounding himself with those that are smarter than him.