The public markets are experiencing high volatility—driven by sweeping tariffs, geopolitical uncertainty, and investor anxiety around a potential economic slowdown. In this kind of environment, many high-net-worth investors are re-evaluating their asset allocation strategies. One increasingly popular question: Is it time to move beyond the public markets?

While publicly traded REITs (Real Estate Investment Trusts) offer exposure to real estate, they behave more like stocks than the underlying real estate itself. This is because public REITs trade on exchanges and are subject to the same sentiment-driven swings as the broader equity markets. This disconnect highlights the key difference between public REITs and private real estate investments: private real estate is less correlated to public markets.

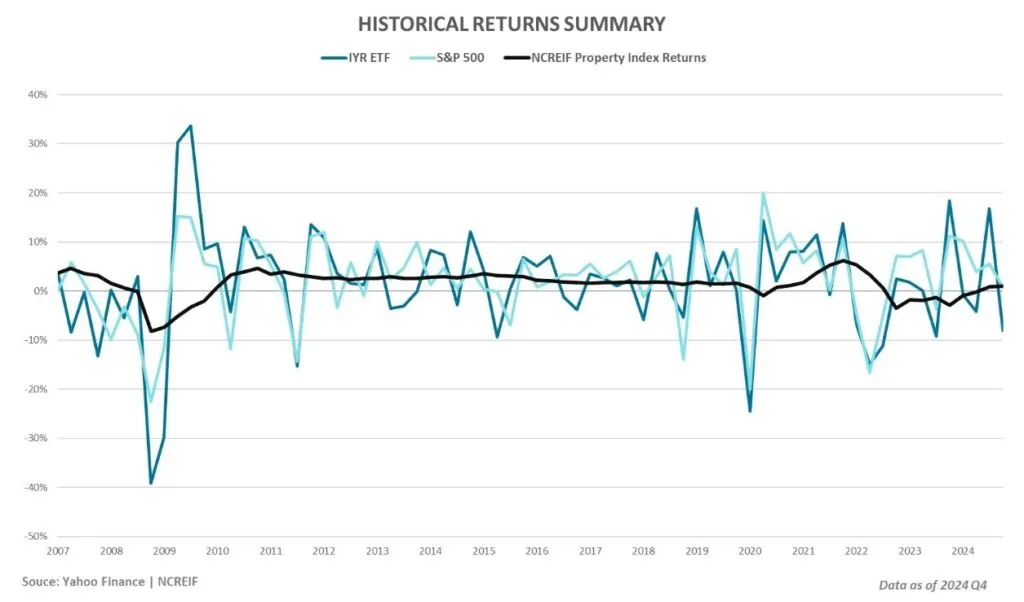

At MLG Capital, we track and compare the performance of public equities, REITs, and private real estate using trusted benchmarks like the S&P 500, the IYR ETF (for public REITs), and the NCREIF Property Index (for institutional private real estate). Historically, and continuing into this volatile 2025 environment, private real estate has shown considerably lower volatility and less correlation with the ups and downs of the stock market.

Overexposure to highly correlated, and currently volatile assets, may result in increased risk when compared with a portfolio that includes private real estate investments.

Private real estate offers accredited investors several potential advantages:

- Reduced volatility compared to public equities and REITs

- Projected cash flow during the investment period

- Favorable tax treatment, including depreciation benefits

- A potential hedge against inflation and market uncertainty

In a volatile market, many investors are looking for tools that help protect and preserve wealth. Private real estate could be a valuable component of a well-diversified portfolio.

Please note that price stability of the fund does not mean that the underlying assets themselves are not subject to fluctuation.

Ready to explore how private real estate could fit into your portfolio? Contact MLG Capital to learn more about our approach, our investment offerings, and how we help accredited investors invest in true private real estate.

*Note:

Private investments are highly speculative, illiquid, may involve a complete loss of capital, and are not suitable for all investors. Past performance is not indicative of future results. Prospective investors should conduct their own due diligence and are encouraged to consult with a financial advisor, attorney, accountant, and any other professional that can help them to understand and assess the risks associated with any investment opportunity.

This blog and associated materials are being presented for informational purposes only and is not an offer to sell interests in a security. A private real estate investment is subject to risks and uncertainty many of which are not outlined herein including, without limitation, risks involved in the real estate industry such as market, operational, interest rate, occupancy, inflationary, natural disasters, capitalization rate, regulatory, tax and other risks which may or may not be able to be identified at this time and may result in actual results differing from expected. Private investments are highly speculative, illiquid, may involve a complete loss of capital, and are not suitable for all investors. Prospective investors should conduct their own due diligence and are encouraged to consult with a financial advisor, attorney, accountant, and any other professional that can help them to understand and assess the risks associated with any investment opportunity.

Past performance is not indicative of future results. Securities offered through North Capital Private Securities, member FINRA/SIPC. Advisory services offered through MLG Fund Manager LLC, an investment adviser registered with U.S. Securities & Exchange Commission.