Every fall, we gather our investors, partners, and team members to reflect on what it truly means to invest for the long term. This year’s Fall Investor Event, “The Long Game,” brought together our community at our Brookfield headquarters for an evening focused on patience, purpose, and the power of compounding. From market insights to candid conversations about strategy and culture, the event offered fresh perspectives on how steady, thoughtful investing can create meaningful results over time. Here are the highlights and key takeaways from an inspiring night.

What We Talked About

We kicked off the evening by exploring the concept of compounding, not just as a financial principle, but as a mindset. The idea that small, consistent actions can lead to big outcomes is something we seek to see play out across our investment strategy.

Principal and CEO, Tim Wallen set the tone: “Tonight’s message is about the long game. To succeed in real estate over the long term, you need an organization built for it.” He emphasized the importance of talent, succession planning, and a culture that attracts and retains great people.

Principal and President, Billy Fox added, “We wouldn’t be here without our investors, many of whom have partnered with us for years. We’re grateful you’re playing the long game alongside us.”

Multifamily Market Insights

Our team shared a snapshot of the current real estate landscape, especially in the multifamily space, supported by the U.S. Census Bureau:

- Demand remains steady, driven by factors like delayed marriage, student loan debt, rising home prices, and higher mortgage rates. Principal and CIO, Dan Price explained, “Demand remains resilient, but we’re currently experiencing a short-term oversupply in multifamily housing. Looking ahead, we expect a housing shortage across the single-family and multifamily sectors.”

- Supply is slowing, which could create opportunities for rent growth, reduced concessions, and stronger occupancy rates in the future, particularly in high supply markets.

Our Approach: Leaning In When Others Pull Back

One of the themes of the night was how we approach moments of market softness at MLG Capital. When operations are in flux, we continue to look for opportunities to acquire high-quality assets in strong sub-markets.

Price described the current environment: “Operations are in large part soft today because we’re working through a period of excess supply, largely in many higher job growth regions of the country. But we’ve had real conviction that it will be a shorter-term condition because of how dynamic the demand growth is in this country, and how dynamic we expect it to be going forward to absorb the new supply being delivered.”

Wallen added a dose of perspective from past cycles: “I don’t like being a market timer. I think conceptually you need to consistently invest over time to maximize tax benefits and the snapback opportunity.”

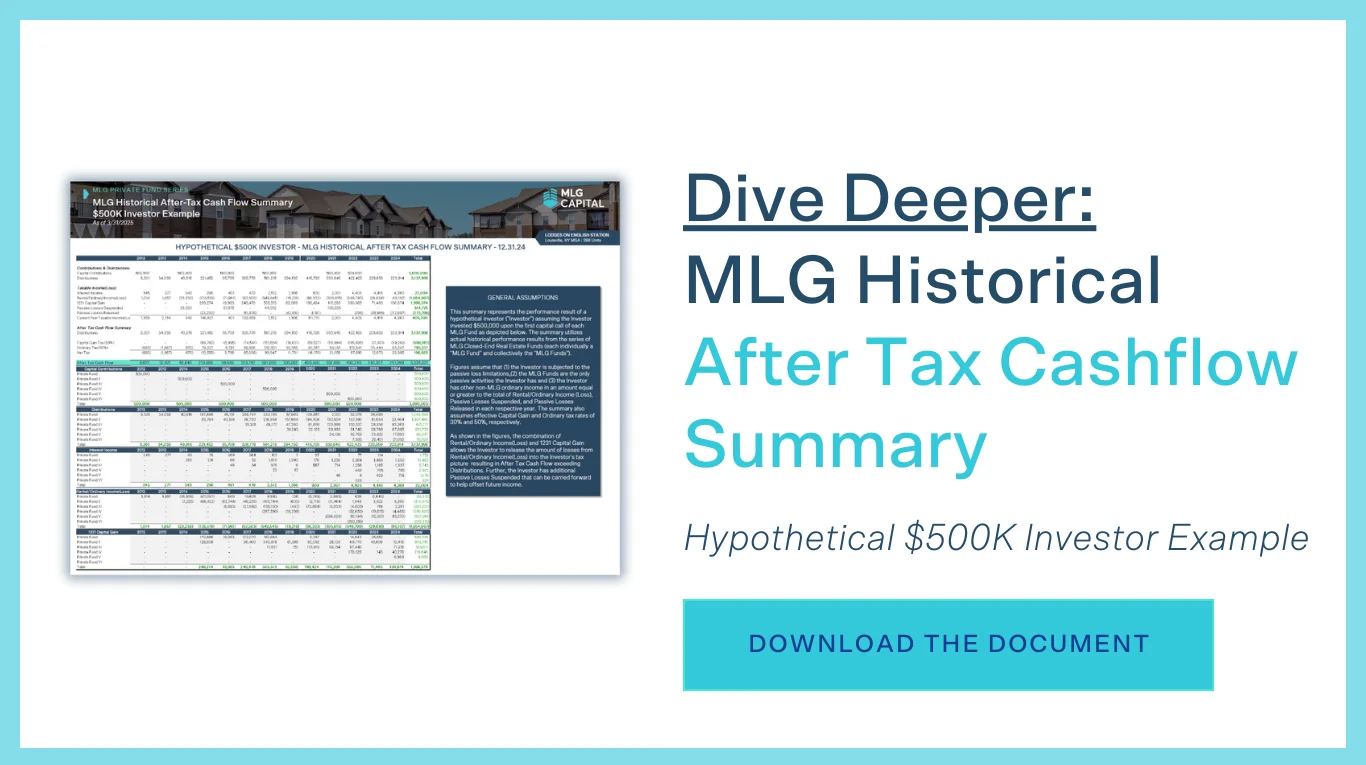

Reinvestment and After-Tax Efficiency

We also walked through a hypothetical example showing how reinvestment and tax efficiency can work together. An investor who participated in each of our last six funds would have seen:

- Around $3.1 million in distributions [1]

- And approximately $3.3 million in after-tax cash flow [1]

This example highlights how tax strategy can play a role in overall outcomes. Of course, individual results vary, and investors should consult their own advisors to understand what applies to their situation. For a deeper dive into the benefits of reinvestment, read our blog on The Tax-Efficient Power of Reinvestment.

The managed account option was also discussed as a way to keep capital working and maximize those benefits. Read more about that program HERE and reach out to your MLG Capital representative to sign up.

Final Thoughts

“The Long Game” is more than an event, it’s our investment philosophy. Thank you to everyone who joined us and contributed to the conversation. Whether you’re a long-standing member of the MLG community or just beginning your journey, we hope you left inspired to think long-term.

Watch: Highlights from our 2025 Fall Event

[1]This summary represents the performance result of a hypothetical investor (“Investor”) assuming the Investor invested $500,000 upon the first capital call of each MLG Fund (Funds I-VI) as depicted above. The summary utilizes actual historical performance results from the series of MLG Closed-End Real Estate Funds (collectively the “MLG Funds”). Figures assume that: (1) the Investor is subjected to the passive loss limitations, (2) the MLG Funds are the only passive activities the

Investor has and (3) the Investor has other non-MLG ordinary income in an amount equal or greater to the total of Rental/Ordinary Income (Loss), Passive Losses Suspended, and Passive Losses Released in each respective year. The summary also assumes effective Capital Gain and Ordinary tax rates of 30% and 50%, respectively. As shown in the figures, the combination of Rental/Ordinary Income (Loss) and 1231 Capital Gain allows the Investor to release the amount of losses from Rental/Ordinary Income (Loss) into the Investor’s tax picture resulting in After Tax Cash Flow exceeding Distributions. Further, the Investor has additional Passive Losses Suspended that can be carried forward to help offset future income

Disclaimer

Securities offered through North Capital Private Securities, Member FINRA/SIPC. Its Form CRS may be found here and its BrokerCheck profile may be found here. NCPS does not make investment recommendations and no communication, through this website or in any other medium, should be construed as a recommendation for any security offered on or off this investment platform.

This article is intended solely for accredited investors. Investments in private offerings are speculative, illiquid, and may result in a complete loss of capital. Past performance is not indicative of future results. Prospective investors should conduct their own due diligence and are encouraged to consult with a financial advisor, attorney, accountant, and any other professional that can help them to understand and assess the risks associated with any investment opportunity.

This offering includes risks and uncertainty many of which are not outlined herein including, without limitation, risks involved in the real estate industry such as market, operational, interest rate, occupancy, inflationary, natural disasters, capitalization rate, regulatory, tax and other risks which may or may not be able to be identified at this time and may result in actual results differing from expected.

Advisory services offered through MLG Fund Manager LLC, an investment adviser registered with U.S. Securities & Exchange Commission.