Private real estate is a tax-advantaged asset class. At MLG, we first focus on making smart real estate investment decisions, then wrap strategic tax planning around those decisions. One financial strategy our investors can take advantage of is the power of reinvesting over time.

When one of our older funds produces a large distribution following the sale of a property, many of our investors consider making new investments into our newest fund. New investments generally create fresh tax losses that could be used to offset taxable income from prior funds within the same year.

To illustrate the power of reinvestment, let’s see what potential tax savings could occur from an investor using their proceeds from a distribution in an older fund to make a new investment into our latest fund offering. This scenario is hypothetical, and it is always wise to consult your tax professional before making any investment decision.

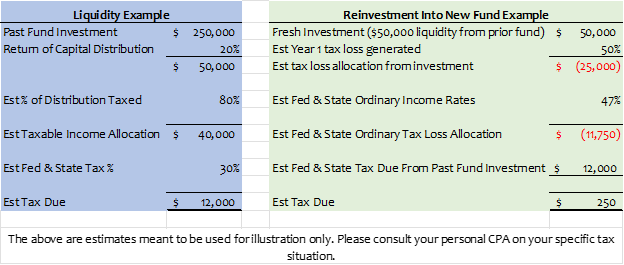

Let’s assume an investor made a $250k investment in one of our prior funds. Let’s also assume that a property sale produced a return of capital of 20% of their original investment amount, or about $50K. Lastly, let’s assume this investor has a high income, and is taxed at the highest marginal federal and state tax rates.

Due to material value appreciation and tax strategy designed to create beneficial ordinary losses in early years, the taxable gain from the property sale could be around 80% of the distribution from sale. If an investor receives $50k as a distribution from the property sale, they would have an estimated capital gain on the sale amounting to $40k. Assuming combined federal and state capital gain rates estimate around 30%, the estimated tax liability because of the sale would be $12k.

That same investor could use the power of reinvestment to offset the tax impact in the year of sale. In our series of diversified private real estate funds, investors generally receive a tax loss in year one of their investment of 40-55%. This is impacted by many factors and strategies we employ, including having several CPAs on staff, performing cost segregation studies, other bonus depreciation rules and section 1231 of the tax code, to name a few.

If an investor took the $50K distribution from the property sale in a prior fund and reinvested into our latest fund offering, MLG Private Fund VII, which opened in Summer of 2022, the investor could receive an estimated beneficial ordinary loss allocation of $25K (50% of capital contributed).

If the capital gain from the prior fund and the ordinary loss from the new fund are classified as passive for the investor, they could potentially enable the investor to use the passive income to offset passive loss in their passive loss limitation calculations required on their tax returns.

Further, after the passive ordinary loss is released, it can potentially offset other ordinary income that the investor may have.

Let’s remember the estimated ordinary loss allocation of $25K. Assuming combined federal and state ordinary income rates of 47%, the benefit to offsetting against other ordinary income could amount to $11.75K. The release of passive ordinary losses from reinvestment could nearly eliminate the tax liability impact from the property sale, and allow the investor to keep their money at work in diversified real estate.

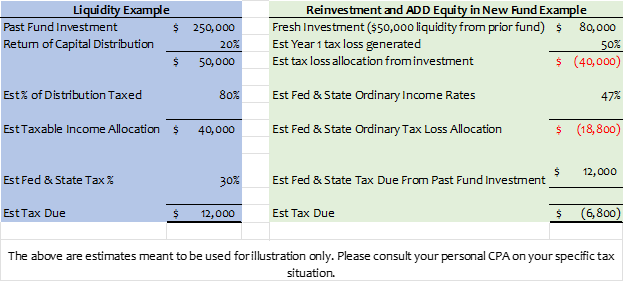

But what if an investor reinvested their liquidity AND added to that investment? Here is an interesting example in which an investor could have a compelling planning opportunity. A reinvestment combined with adding additional funds could result in a refund to investors.

Investors who actively allocate to private real estate year-over-year could continue to produce fresh taxable losses and use them to offset taxable income from prior investments. This can increase an investor’s after-tax return on investment over time.

If you’ve recently received a distribution from a prior investment that is triggering taxable income, consider working with your tax advisor on what strategies could be most efficient for your personal situation. An investment in MLG Private Fund VI could be an attractive option for producing tax efficiency.

Rick Reuter is Principal and Controller at MLG Capital. He has management responsibility over MLG Capital’s accounting, investor reporting, fund administration, treasury, and tax functions. Rick also plays a key role in fund/investment structuring including the launch of the MLG Legacy Fund.

This blog and associated materials are being presented for informational purposes only and is not an offer to sell interests in a security. A private real estate investment is subject to risks and uncertainty many of which are not outlined herein including, without limitation, risks involved in the real estate industry such as market, operational, interest rate, occupancy, inflationary, natural disasters, capitalization rate, regulatory, tax and other risks which may or may not be able to be identified at this time and may result in actual results differing from expected. Private investments are highly speculative, illiquid, may involve a complete loss of capital, and are not suitable for all investors. Prospective investors should conduct their own due diligence and are encouraged to consult with a financial advisor, attorney, accountant, and any other professional that can help them to understand and assess the risks associated with any investment opportunity.

This blog contemplates complex tax concepts that each recipient should review with their professional tax advisor for further guidance. This presentation should not be considered tax advice and each recipient should consult with their tax advisor regarding the content, definitions and assumptions outlined in this blog.

Past performance is not indicative of future results. Securities offered through North Capital Private Securities, member FINRA/SIPC. Advisory services offered through MLG Fund Manager LLC, an investment adviser registered with U.S. Securities & Exchange Commission.