Perhaps you’ve thought about diversifying your traditional portfolio and considered real estate as a potential solution. Or, maybe you’re only familiar with real estate investment trusts (REITs) as a form of real estate investing. The world of private real estate provides new, and in my opinion, strategic alternatives compared to simply investing in public REITs.

In a world where everything feels like it’s been turned upside down, many investors take comfort in the familiarity and ease of stocks and bonds, but they may miss out on the opportunities and benefits private real estate offers. It’s been my experience that investors recognize the advantages to private real estate but are apprehensive to take the jump into investing due to the unfamiliarity of it. Investing in private real estate may offer benefits you may not find in a portfolio made up of REITS, stocks and bonds alone:

- Diversification

- Low correlation to public markets and less volatility

- Tax-deferred income

- Cash flow and long-term appreciation

Let’s take a deeper dive:

DIVERSIFICATION

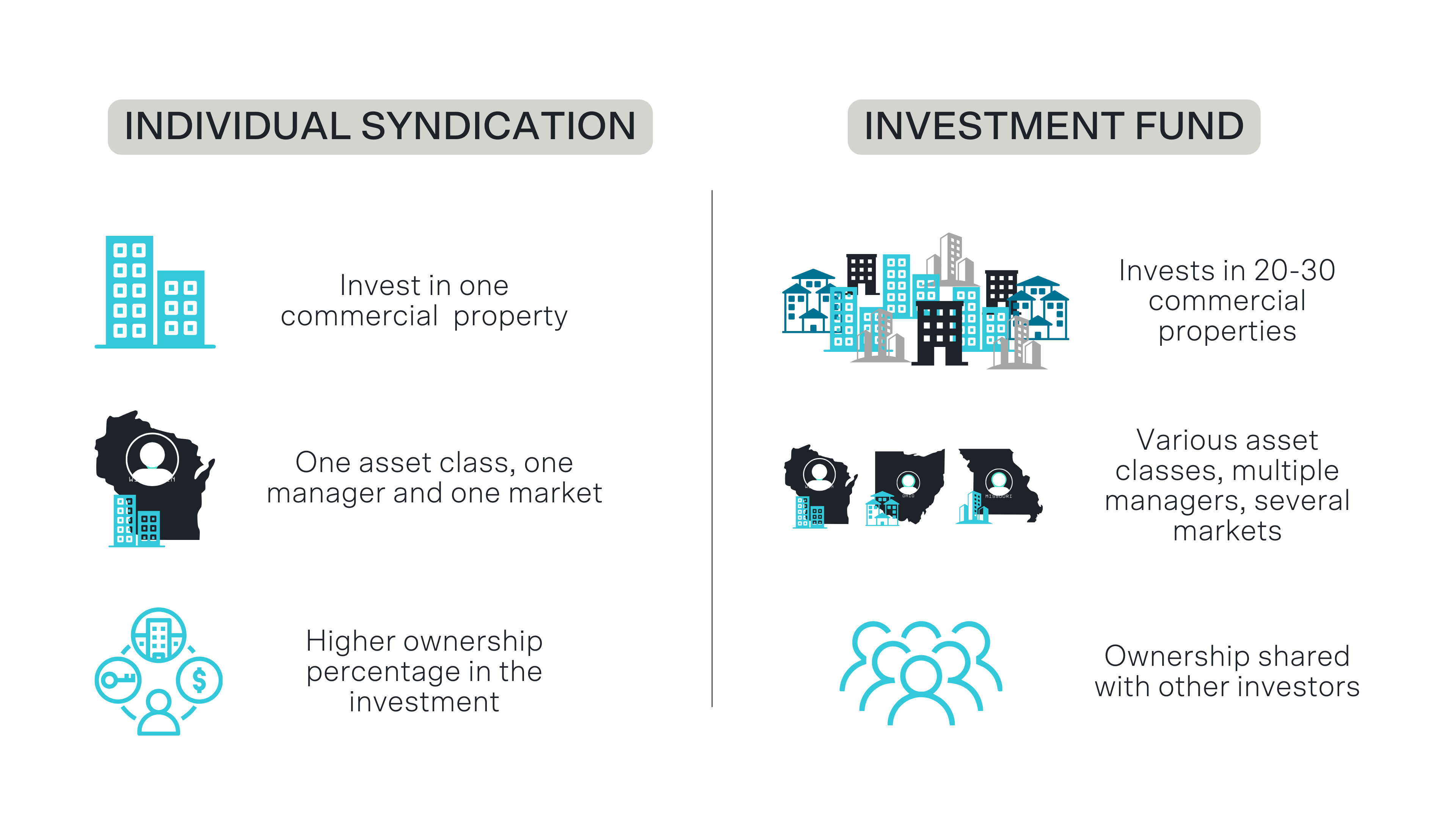

Geographic, asset type, and real estate manager diversification is a key part in creating a successful investment portfolio, as it has the potential to shield investors from added risk, and it can also preserve an investor’s capital. Many private real estate investments are done on a local basis, primarily investing in their local communities. Don’t get me wrong, this is great for the local market and community, but it doesn’t help to diversify an investment portfolio across asset classes and markets. With a private real estate fund, investors may be exposed to various asset classes, markets, and managers. This can help investors, particularly when the stock and bond markets are experiencing volatility and large dips. Here’s a helpful visual:

LOW PUBLIC MARKET CORRELATION AND LESS VOLATILITY

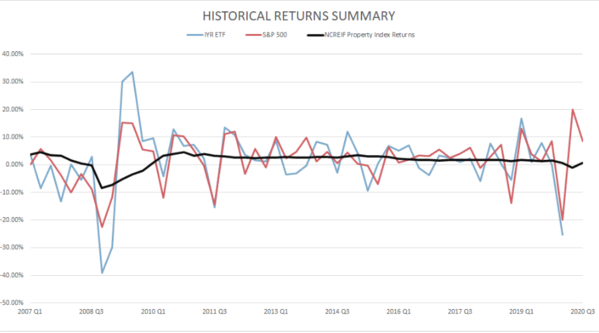

As I’ve said above, when investors think of real estate, they tend to look exclusively at publicly traded Real Estate Investment Trusts (REITs). However, REITs are traded on the same exchanges as stock and bonds and are exposed to the same public market risk. Conversely, private real estate typically has a low correlation with the S&P 500 and REITs, meaning investors can have the unique opportunity to grow their capital, regardless of the volatility in the public markets. A visual may help put this into context:

Notice the consistency of the returns of the property index in comparison to the volatility of the S&P.

The S&P 500 is the leading indicator of U.S. Large Cap Equities while the IYR ETF seeks to track the investment results of the Dow Jones U.S. Real Estate Index, which measures the performance of the publicly traded real estate sector of the U.S. equity market. The NCREIF Property Index is a quarterly measure of the unleveraged composite total return for private commercial real estate properties held for investment purposes only. As the NCREIF is unleveraged private real estate, it’s inherently less volatile, as depicted above.

Along with market volatility, another macro risk to your portfolio can come from higher interest rates. While we’ve been in a low interest rate environment for quite some time, in times of higher interest rates, public market assets (like stocks and bonds) have had a poor history of generating sufficient returns. This concept goes hand in hand with inflation; as the higher the inflation rate, the more interest rates are likely to rise.

Historically, private real estate showed the highest rate of returns within an inflationary cycle especially when compared to other popular investment vehicles (REITs, stocks, bonds, etc.). Looking specifically at multifamily, leases are typically short-term, and rents can be raised to counter increases in operating costs.

TAX-DEFERRED INCOME

When purchasing real estate, we will generally use a cost segregation study to break up the purchase price into various components of the asset. Each component can then be treated separately for depreciation purposes. Additionally, allocations to assets with shorter class lives and assets that are eligible for bonus depreciation can materially accelerate beneficial depreciation deductions. These depreciation deductions can then be used to reduce the rental income and even create beneficial taxable losses for investors.

At MLG Capital, we often find that a first-year loss allocation in our funds can amount to around 50-60% of capital contributed and these beneficial losses are all passed back to investors. Of course, these are just paper losses, as the assets may be producing positive cash flow, but these losses can be very powerful, as they can commonly be used to offset and defer other passive income that investors may have within their portfolio. If investors don’t have other passive income to offset the losses can often be carried forward to offset future passive income and/or be released upon the sale of assets.

This benefit may result in significant tax deferred income for investors. This can be a very powerful tool, especially, for folks who are highly compensated and highly taxed. This income is typically classified as ordinary income and can often be subject to tax rates at or near 40% (plus state taxes on top)! The ability to defer this income is meaningful as it allows investors to capture the benefit of the time value of money – a dollar in your pocket today is worth more than a dollar in your pocket five years from now.

In addition to the tax deferral benefit, recognizing gains at capital gain tax rates instead of ordinary income rates can be beneficial. The sale of real estate can often lead to taxable gains characterized as 1231 gains. This means that they can be taxed at the lower capital gain rates (20-25% for higher income tax brackets). Taking losses at ordinary rates and recognizing gains at capital gain rates can be a very powerful combination for investor after tax returns.

CASH FLOW AND LONG-TERM APPRECIATION

Scarcity of land and supply in constrained markets allow property owners to increase rent over time. At the same time, capital expenditures and improvements into a property may further increase rent growth potential, creating additional value.

At MLG Capital, we look to acquire assets where there is potential to grow operating income and/or reduce operating expenses. If you look at the real estate market, you will quickly realize that real estate is a fractured and fragmented market with many people investing with varying degrees of talent and skill. While others may sit back and wait for asset appreciation to do their job, MLG Capital takes a different approach and proactively works to increase both the cash flow and asset values of the properties we acquire.

It’s the focus of our jobs to find properties where someone doesn’t see the full potential. Simply put, we are looking to find the diamonds in the rough, and we’ve been successful at doing just that for over 34 years.

While investing in private real estate may seem like unchartered territory for some investors, it’s worth taking a deeper dive and exploring how the many benefits can apply to your personal financial picture.

Our team is ready to walk you through MLG’s longstanding history investing in private real estate and our unique solutions for both novice and experienced real estate investors alike. Learn more.

Understanding the Risks of Private Investments

Investing in private offerings, like our Fund, Legacy Fund, Co-Investment, or 1031 Exchange Program, comes with its share of risks and uncertainties. While we can’t cover every potential risk here, it’s important to be aware that the real estate industry is influenced by many factors. These include market fluctuations, operational challenges, interest rate changes, occupancy levels, inflation, natural disasters, capitalization rates, regulatory shifts, and tax considerations. Some of these risks may not even be identifiable at this time and could lead to outcomes different from expectations.

Lindsey Collings is a Vice President at MLG Capital, focused on sourcing deals in the Southwest region for MLG’s JV private equity strategy. She also leads MLG’s Registered Investment Advisor initiative nationwide and works with a number of MLG’s current and prospective investors. In her free time, she enjoys spending time with her family and friends, golfing, and cooking.