Smart Real Estate Investments. Relationship Driven.

For more than 38 years, our core focus has been working to preserve our investors’ wealth and producing tax-advantaged income and appreciation over time through investment in private real estate. Learn more about investing in our fund offerings.

The Key to Our Investment Success

Our people are at the heart of MLG Capital. A commitment to absolute integrity and making a difference while making a living drive what makes us different from any other real estate investment company out there.

±$8.3B

Market Value 2

±46K

Multifamily Units 1

±52.8M

Square Feet 3

New Investor or Returning? Start Here.

We’re excited to be your guide through private real estate investing.

Exclusive Real Estate Investment Opportunities

Our real estate investment funds provide access to opportunities that aim to produce tax-advantaged cash flow and appreciation over time. These opportunities are thoroughly reviewed and vetted by our team and through the lens of our 38+ years of experience.

Diversification

Our funds target investments in multiple asset types, states and even with multiple real estate managers. Our Private Real Estate Fund structure targets 25-30 investments.

Public Market & Inflation Hedge

Generally, private real estate has a low correlation to the public markets and may be uniquely positioned to perform in a growing economy.

Tax Efficiency

We wrap quality tax planning around our transactions. Our team utilizes a range of sophisticated investing strategies targeted to address tax burden and enhance after-tax cash flow.

Cash Flow & Appreciation

Real estate takes time. The time spent building a real estate portfolio may be rewarded by producing cash flow and appreciation over time through the execution of business plans to improve asset cash flow.

The Potential Benefits of Investing in Private Real Estate

Appreciation of Value

Reliable income from real estate investments can potentially make a greater return comparative to markets, with less volatility.

Tax Efficiency

Potential Inflation Hedge

Private Real Estate vs. Public Markets

Private real estate investment returns do not mirror returns achieved in the public markets, offering the potential for greater stability. See below for a comparison of the S&P 500 (public equities index), IYR ETF (public REIT index), and NCREIF (private real estate) over the last 20+ years.

Source: Yahoo Finance | NCREIF

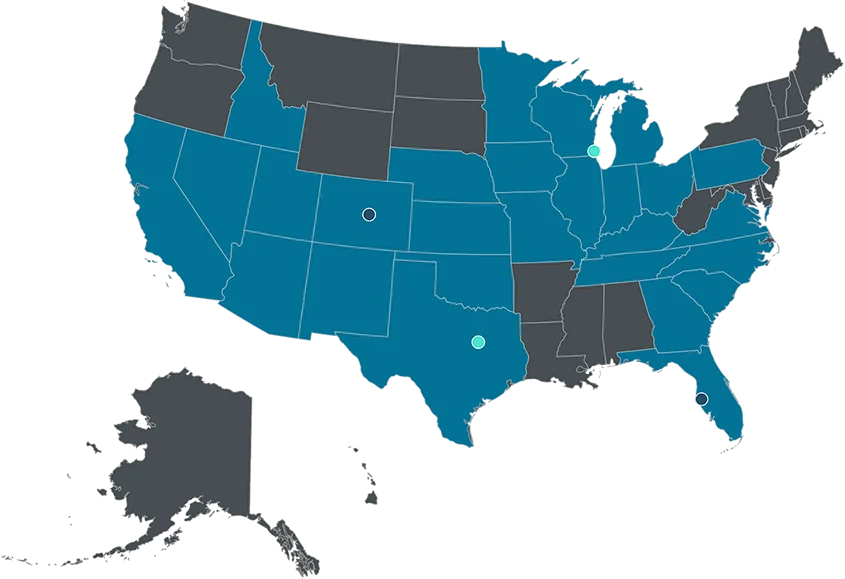

Nationwide Reach

Data below as of 6/30/2025

0

Total Contacts

0

Owners, Operators, & Sponsors

0

Investment Brokers & Others

0

Mortgage Brokers

Wisconsin Headquarters

Located in Brookfield, a suburb of Milwaukee, Wisconsin, in a repurposed grocery store, our roots are grounded in grit and determination you can only find in southeast Wisconsin. That’s what sets us apart from anyone else in private real estate.

Denver

Soon to open late Q1 2024, we now have dedicated, local feet on the ground to assist with acquisitions and investor relations in Colorado and the Mountain West United States.

Dallas

Located at the heart of a strong real estate market, our office in Dallas serves as our hub for acquisitions in the Sun Belt.

Sarasota

Our office in Sarasota not only provides convenient access to getaways from northern winters, but also provides us an opportunity to have feet on the ground in one of America’s fastest growing states.

- Primary Office Locations

- Satellite Offices

- Targeted Acquisition Markets

Partnering with MLG Capital

Whether you are looking to sell a multifamily, industrial, retail, office, or another real estate asset, partner with a trusted real estate company for joint venture, or contribute your owned asset to our Legacy Fund – we want to learn more about your property and deal.

Real Estate Experts

Investment Insights to Keep You Ahead

Our 2025 Year in Review

What the Enacted Tax Bill Could Mean for Real Estate and MLG Investors in 2025

Inside MLG’s Latest Offering: Private Fund VII and the Power of Diversification

Don’t take it from us.

The individuals giving the testimonials referenced above are investors of MLG and have not received any compensation for such testimonials. Testimonials may not be representative of the experience of other customers and are not a guarantee of future performance or success.

Let’s Partner Together

Consult the experts in private real estate investing and asset acquisition. We can walk you through the ways real estate may benefit your investment needs.

1. As of 9/30/2025

2. As of 9/30/2025, for determination of Market Value, sold properties are valued at actual sales price. Active and pending investments are based on MLG’s estimate of current value. Recent acquisitions are generally valued at the acquisition price.

3. As of 9/30/2025; Square Feet includes multifamily properties.