Partners wanted.

If you’re looking to expand or diversify your client’s investment portfolio to include private real estate, you’re in the right place. Partner with us and take advantage of our 38+ years of industry experience.

Success by the numbers.

Through various economic cycles, we have successfully owned and operated real estate for over three decades.

38+

Years

±$8.3B

Market Value2

52.8M

Square Feet2

23

States Historically Invested Into 1

MLG does not share in the profits until clients have achieved an 8% cumulative preferred return and full return of original principal (European Waterfall).

Learn More about the European Equity Waterfall.

Investment Model4

Advisors that refer or invest over $5 million per fund receive enhanced profit-sharing terms: 80% to investors and 20% to MLG.

*Preferred rate of return is not guaranteed

- Across all MLG affiliate companies there are 950+ total employees, as of 12/31/23

- MLG’s team includes in-house staff of 55+ professionals who focus on a wide variety of job functions including:

- Acquisition Professionals

- Investor Relations

- CPAs, Audit Staff & Tax Directors

- Internal Fund Administration

- Attorneys and Legal

- Engineers & Land Planners

- Real Estate Brokers & Professionals

- Accounting & Asset Management

- Property Management

- The management team consists of six principals who have been investing in real estate together at MLG for an average of 28 years.

- MLG’s Investment Committee is comprised of eight individuals including Principals, Senior Vice Presidents, and Vice Presidents with diverse real estate backgrounds.

- MLG seeks to manage fees and create a low fee structure for its investors.

- 1.25% asset management fee on invested capital.

- Market property-level fees

- 24-hour access to fund-level reporting through institutional-quality investor portal.

- Audits completed annually by Deloitte & Touche, providing investors greater transparency over financials.

- MLG’s Investor Operations team is a dedicated service team, focused on maintaining the quality of service and investor experiences.

- Customized communication preferences allow investment advisors to determine the depth and frequency of communication based on their preferences.

- Investing in private real estate may result in tax benefits that can be a benefit to investors. While tax consequences should not be the sole driver of investment decisions, it may be wise to wrap smart tax planning around successful investments. MLG uses a range of strategies to maximize after-tax cash flow including cost segregation studies, utilizing the bonus depreciation rules, and being willing to sell investments to trigger long-term capital gains.

- Cost segregation studies can be used to break up the purchase price into various components with shorter depreciable lives to maximize depreciation deductions.

- Bonus depreciation may allow investors to claim much of the depreciation benefit in the first year, which may create passive losses that are typically passed through to investors. It’s important to note that these are paper losses and not an actual loss of value.

- For investors who have passive ordinary income, passive ordinary losses may be used to offset and defer such income.

- MLG expects to produce passive losses in the range of 40-50% of investor’s initial investment in their first year of investment in our Private Funds.

- MLG has unique product offerings to cater to Investment Advisors and their clients’ unique situations:

- Our Dividend Fund is an entrance vehicle into our Fund VI. The private REIT is structured to avoid UBTI (unrelated business taxable income) and multi-state filings for foundations, endowments, and retirement accounts.

- MLG’s Legacy Fund is specifically designed for investors to contribute property. The Legacy Fund is an alternative to conventional tax deferred exit strategies like 1031 exchanges, Delaware Statutory Trusts (DSTs), and UPREITs. The Legacy Fund offers contributors of property passive ownership, tax efficiencies, member flexibility, and diversification.

- We’ve written blogs to answer common questions your clients may have about our funds:

Which Fund Option is Right for Me?

Why the Legacy Fund is the Superior Real Estate Exit Strategy

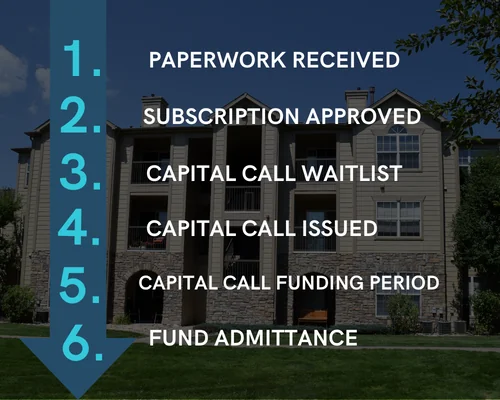

- MLG’s capital process is aligned with advisor needs: MLG does not have a capital drawdown process over many years like many institutions where capital is locked up while the fund is raising capital.

- Instead, a rolling subscription process is utilized, and targets original equity called within approximately 3-6 months of subscription approval.

- 100% of capital commitments are called at one time.

- Capital Call Process:

- The typical investor follows the traditional distribution model (8% preferred return, full return of capital, and a profit sharing split of 70% to investors and 30% to MLG.)5

- Advisors that refer or invest over $5 million per fund receive enhanced profit-sharing terms: 80% to investors and 20% to MLG.

Two for the money.

The biggest challenge to growing private real estate funds? Finding private real estate opportunities. That’s why we got creative with our acquisition model and perfected a dual-sourcing strategy. We constantly source opportunities from our expansive network of relationships through both joint ventures and direct acquisitions. With these two sourcing avenues, we target 1-2 acquisitions per month, on average.

Joint Venture (JV)

With numerous partnerships across the nation, we capitalize on local knowledge to find real estate deals. Our joint venture acquisition strategy is focused on real estate in positive economic markets with job and population growth.

Key Relationships: Foster relationships with local real estate partners..

Diversity: By geographic, asset type and partner/sponsor.

Deal Flow: Critical selection of the smartest investments possible.

Direct Acquisitions

Our second acquisition strategy falls within target asset classes (i.e. apartments, industrial, retail, and office) and includes states where MLG is located or states where we have long-established and historical relationships.

Experience: Time-tested and proven.

Local Staff: “Boots on the ground” approach.

Reach: Owning and operating multiple properties within a given MSA.

True Diversification

Any investor knows that diversification is essential. But there’s more than one way to diversify. And if you dig a little deeper, you’ll find that many investments aren’t nearly as varied as they claim to be. At MLG Capital, you’ll find true diversification in funds that differ in geographic areas, asset types, types of commercial real estate, and even multiple real estate managers. We find that this creative mixture of assets provides the highest opportunity for our investors.

0

in Market Value2

0

Multifamily Units1

Flexible investing.

With multiple ways to serve your clients, we have real estate investment solutions that can help advisors create and maintain wealth.

MLG Private Funds

Our investor-centric fund structure provides the opportunity to invest in a fund that targets diversification, prioritized cash flow, and low leverage with a unique dual-sourcing strategy.

Diversification

The fund invests in multiple asset types and states, with different real estate managers, targeting 25-30 investments.

Cash Flow

While building a real estate portfolio, your clients will have the potential for cash flow and appreciation.

Low Market Correlation

Private real estate is uniquely positioned to handle a growing economy.

MLG Legacy Fund

Our Legacy Fund was specifically designed to provide owners of commercial real estate the option to dispose of their property while benefiting from an investment in a professionally managed, diversified real estate fund. Owners may contribute their property via a tax-deferred transaction in exchange for units in the fund.

Passive Ownership

Own property without the hassle of owning property. Our professional management and affiliates handle the day-to-day concerns of being a landlord.

Tax Efficient

Contribute assets to the Legacy Fund, potentially without recognizing capital gains. A potential benefit includes the depreciation of new assets acquired by the Legacy Fund, which may reduce current income taxes.

Risk Reduction

Avoid the challenges of selling appreciated assets through a 1031 exchange and trading into inferior assets due to timing constraints. Instead, enhance diversification in a fund that targets multiple property types and markets.

Managed Accounts

Our approach is focused first on capital preservation, followed by income and appreciation to enhance after-tax returns. Contact us for more details.

Frequently Asked Questions

How do you explain your “low fee” model and how is that sustainable?

What is the minimum investment?

How does investing with MLG compare with REITs?

MLG’s non-traded REIT (“Dividend Fund”) is structured to avoid UBTI and multi-state filing for foundations, endowments, and retirement accounts, without the public market risk. Portfolios with only equities and fixed-income securities can leave investments over-exposed to public market risks and volatility.

How does MLG achieve tax efficiency?

- Cost Segregation Studies

We break up building purchases into different asset classes to maximize depreciation deductions. Third-party engineers or CPAs perform the analysis and provide key documentation to support allocation. - Depreciation Rules

Utilizing revised bonus depreciation rules has opened the door for more generous tax write offs for both commercial and residential rental real estate. - Selling for Favorable Tax Rates

MLG is willing to sell investments (versus holding indefinitely) to trigger long-term capital gain tax rates and the ability to use passive ordinary losses to offset other ordinary income.

What makes MLG a trusted real estate investment firm?

MLG’s 38+ years of experience, vertically integrated operations, and consistent performance across multiple market cycles position it as a trusted real estate investment firm focused on long-term value creation and investor alignment.

How does MLG differ from other real estate investment companies?

Unlike many real estate investment companies that outsource property management or acquisitions, MLG manages these functions in-house. This integrated structure improves efficiency, transparency, and control over each investment’s performance.

All questions and answers noted on this page are generated by MLG Marketing LLC and are not assumed to be fully correct. If there is any inconsistency between these Q+As and any offering Private Placement Memorandum, Subscription Document Booklet, all which can be amended from time to time, the Private Placement Memorandum of MLG Private Fund VI LLC, will govern.

Recipients are encouraged to review the entire PPM of Fund VI and relevant fund supplements, which are available upon request.

“Manager” means MLG Fund Manager LLC, the managing member of Fund VI

“Fund” means MLG Private Fund VI LLC, a Delaware limited liability company

“PPM” means the Confidential Private Placement Memorandum for the Fund (Version 1.0), as updated by the most current Supplement

“MLG Capital” or “MLG” means the Manager’s investment Affiliates, as more fully defined in Section IV of the PPM.

Investment Insights to Keep You Ahead

Let’s Partner.

Since 1987, we’ve owned and operated real estate while successfully managing through multiple economic cycles. Partner with the premier outsourced real estate manager.

2. As of 9/30/2025; for determination of Market Value, sold properties are valued at actual sales price. Active and pending investments are based on MLG’s estimate of current value. Recent acquisitions are generally valued at the acquisition price.

3. As of 9/30/2025; Square Feet includes multifamily properties.