Each year, MLG Capital issues its Market View commentary to offer a clear, data– driven perspective on the state of the private commercial real estate market. In Spring 2025, CEO Tim Wallen, President Billy Fox, and CIO Dan Price convened to discuss market trends and where they see opportunity in the market today.

The following highlights from our 2025 Market View discussion explore where we see risk, where we see resilience, and why we are actively deploying capital in the current environment.

Key Themes from the Spring 2025 Market View Discussion

Soft net operating income (NOI) is creating tactical entry points, not permanent impairments.

Operating income across multifamily assets has come under short–term pressure due to record supply deliveries in 2023 and 2024, particularly in high-growth markets such as the Sunbelt. This temporary imbalance has generally reduced occupancies, flattened rent growth, and increased concessions. MLG views this softness not as structural deterioration, but as a cyclical occurrence that is already beginning to normalize in select markets. As operational performance recovers, assets acquired during this window may benefit from meaningful NOI growth over the mid– to long–term.

The supply and demand imbalance is correcting and setting the stage for future potential upside.

While deliveries peaked in 2024, new construction starts are falling sharply. Developers are grappling with the challenges of elevated interest rates, capital constraints, and higher costs which are slowing new project initiations. At the same time, long-term demand drivers remain intact. These dynamics suggest that current softness in fundamentals is transitory, and that the forward–looking supply pipeline is unlikely to meet structural demand over the next decade.

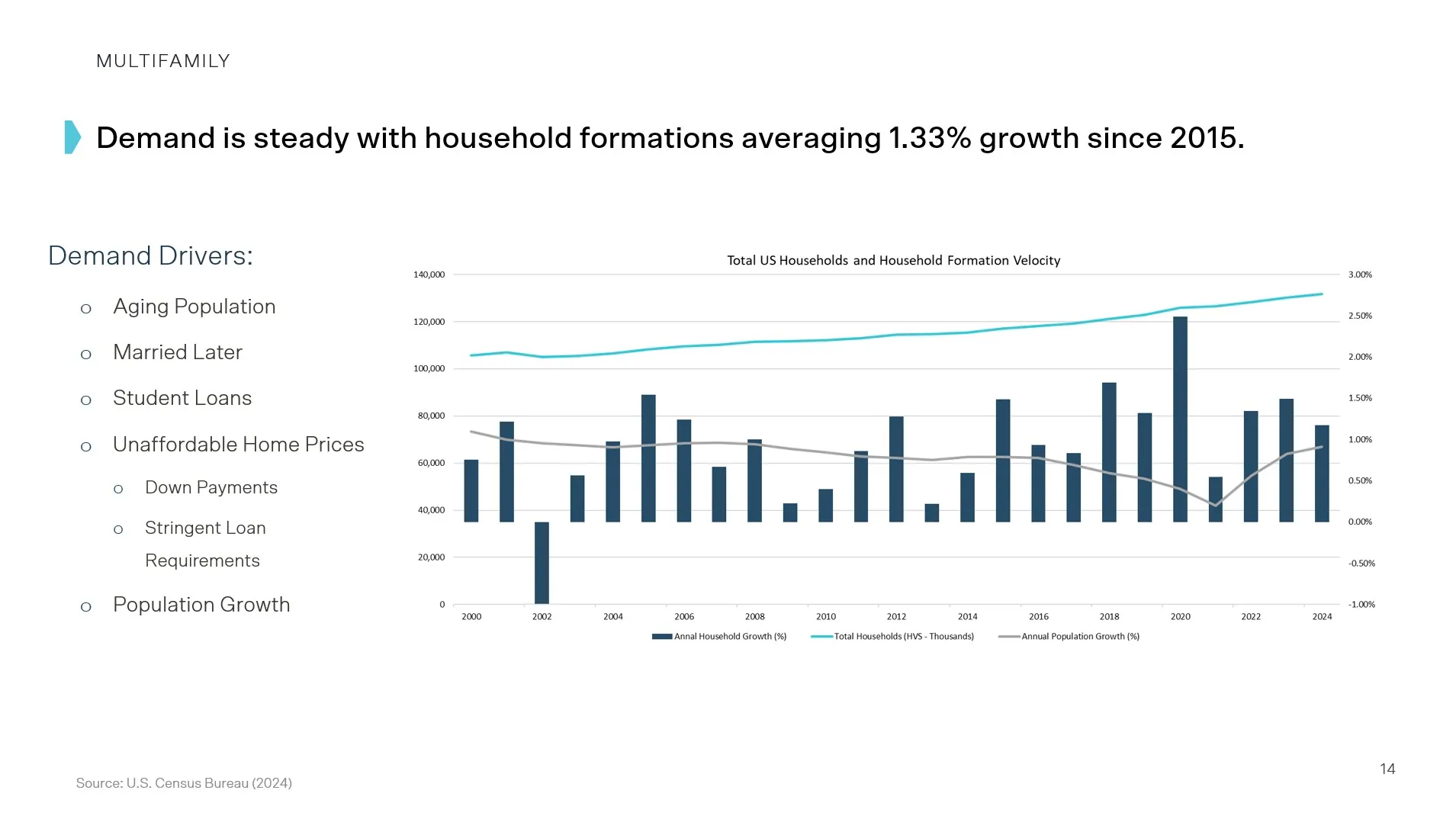

Household formation keeps driving demand.

Household formation in the U.S. has grown at an average annual rate of ~1.3% since 2015, outpacing population growth due to changing lifestyle preferences. Factors such as delayed marriage, aging populations living alone longer, and economic barriers to homeownership are pushing more individuals into rental housing. The need for quality, well–located rental housing is not going away.

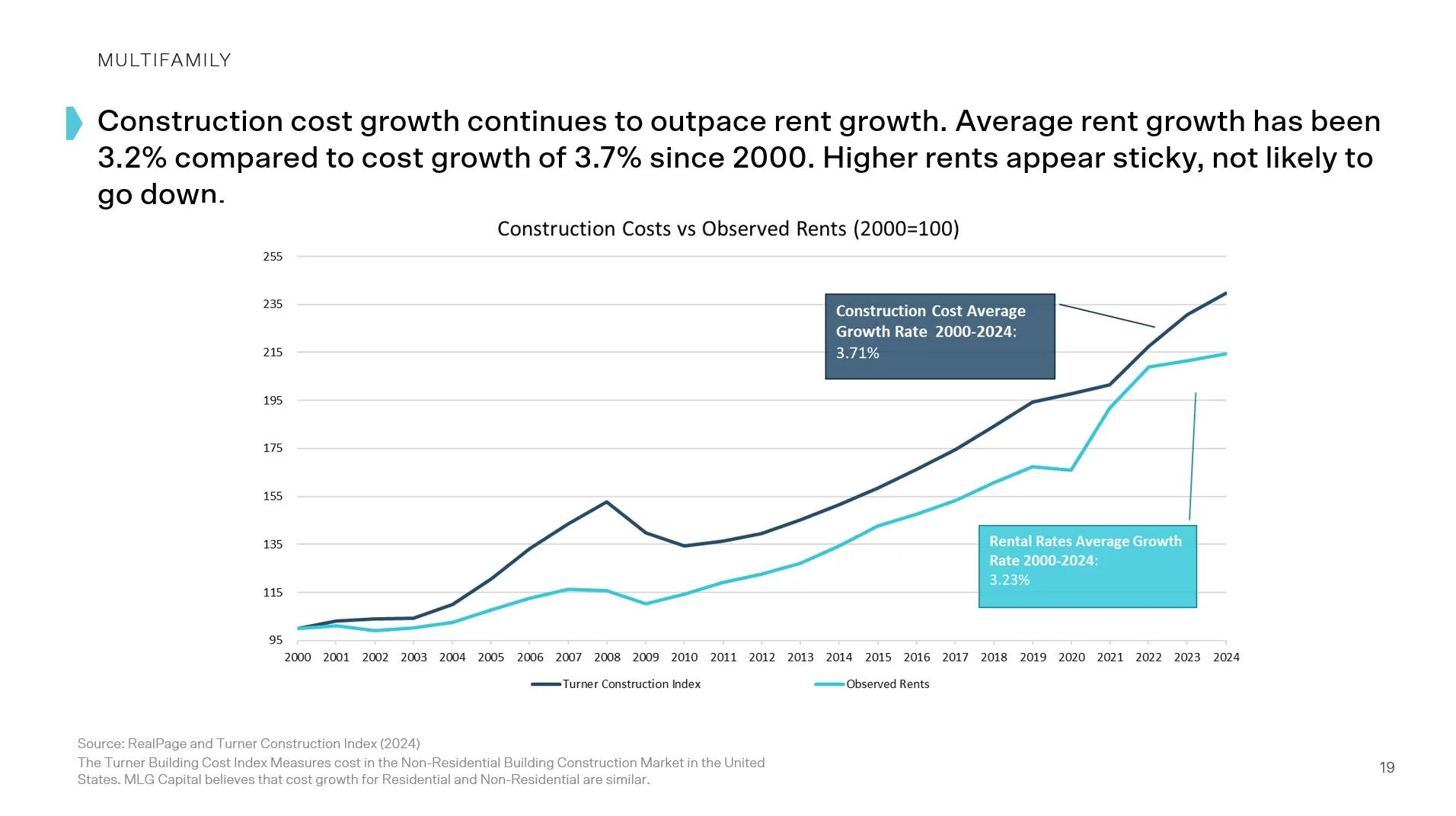

Construction costs are rising faster than rents, making new development increasingly unfeasible.

Since 2000, construction costs have increased at a compound annual rate of 3.7%, outpacing average rent growth of 3.2%. This trend has accelerated in recent years due to labor shortages, material inflation, and persistent logistical challenges. The rising cost basis makes new development less economically viable, particularly in the absence of government subsidies. As a result, the feasibility of ground-up development has materially declined, creating an opportunity to acquire existing assets well below replacement cost.

Tariff policy and inflationary pressures are compounding cost challenges.

Rising geopolitical tensions and ongoing trade restrictions have introduced further volatility into input costs for new construction. Tariffs on imported goods — including steel, aluminum, and key building materials — have added incremental inflation to the real estate supply chain. While these pressures may be episodic, they further reinforce the difficulty of delivering new supply at scale in the current environment and underscore the relative value of well-located existing assets.

At MLG Capital, we invest through all market cycles. We remain focused on acquiring high-quality assets priced below replacement cost, particularly those where we anticipate operational income growth and potential valuation upside, especially as capital begins to reenter the market.

Multifamily: Temporary Imbalances, Structural DemandK

Multifamily fundamentals remain intact, with long–term demand drivers reinforcing the asset class despite current operational softness.

Highlights from the Discussion.

Household formation is outpacing population growth.

Household formation is averaging approximately 1.33% annually over the past decade. This divergence is driven by delayed marriage, an aging population living alone longer, and a growing cohort of renters-by-necessity. These structural shifts are not cyclical. They reflect durable changes in U.S. housing behavior.

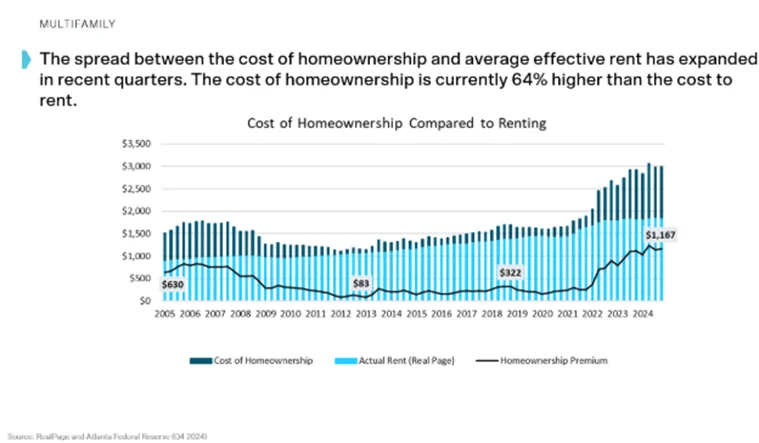

Affordability constraints continue to push demand toward rental housing.

As of early 2025, the cost of homeownership exceeds the cost of renting by approximately 64%, the widest margin recorded in over two decades. This growing delta is extending rental lifespans and expanding the renter base, particularly among middle–income households.

New construction starts are falling sharply.

Developers face mounting headwinds from interest rates, financing constraints, and construction inflation. Quarterly starts have declined to approximately 80,000 units, well below the estimated 430,000 units needed annually to meet the demand from household formation trends. This projected undersupply is expected to tighten the market in the coming years.

Cost escalation continues to erode new development feasibility.

Since 2000, construction costs have risen at a compound annual rate of 3.7%, outpacing rent growth at 3.2%. This growing gap makes ground-up multifamily increasingly difficult to underwrite, particularly without subsidy or premium pricing.

Workforce housing shows structural challenges

While renter demand for workforce housing remains strong, the segment continues to face persistent structural and operational challenges and tenants have been disproportionately impacted by inflation. In many markets, operating costs are rising faster than achievable rent growth, with insurance premiums, property taxes, and other expenses outpacing the revenue potential of these assets. Properties serving workforce renters often cannot pass through these costs without exceeding affordability thresholds — compressing margins and limiting return potential. At the same time, capital expenditure needs are both significant and recurring. Much of the workforce housing stock is aging and requires ongoing investment in mechanical systems, building exteriors, and common areas, investments that are essential to maintain occupancy and livability but do not necessarily translate into higher rents.

Industrial: Scarcity, Specialization, and Strategic Focus

While much of the industrial sector is navigating supply-driven volatility, the flex industrial niche remains undersupplied in our opinion, structurally sound, and well-positioned for stable rent growth.

Highlights from the Discussion

The industrial sector has seen a surge in new supply—primarily in bulk distribution.

Over the last three years, institutional capital heavily favored large-format logistics assets, leading to a wave of new development in the 250,000+ square foot distribution segment. This has resulted in some softening in occupancy and rent growth within the bulk industrial space.

Flex industrial, by contrast, remains deeply undersupplied.

Despite representing a significant share of tenant demand, flex product — defined by multi-tenant, small-bay spaces with many containing small office components — accounts for just a fraction of recent development. Over the last several years, new FLEX industrial construction space has not been a focus. Due to this lack of new supply, a supply and demand imbalance remains present which may support continued rent growth.

Flex assets are expensive to replicate and difficult to entitle.

These properties are often located in infill submarkets with zoning and land constraints, making them both scarce and durable. Communities typically favor large-scale industrial for tax revenue and job creation, making approvals for smaller bay, multi – tenant product more difficult to obtain.

Rent growth is often outsized in nominal terms.

Smaller units allow for greater pricing flexibility: a $1–2/SF rent increase may represent 10–20% in percentage growth while remaining a manageable cost for tenants. This dynamic enhances cash flow growth without significant tenant churn.

Occupancy remains strong across MLG’s flex portfolio.

While overall industrial vacancies have modestly increased, occupancy in flex industrial remains above 90%, driven by demand from local businesses, service providers, and light manufacturing users. These tenants value access, location, and affordability more than scale.

MLG believes we are acquiring flex assets well below replacement cost.

In many markets, we are purchasing existing industrial properties at prices, what we feel, are substantially below the cost of new construction. This pricing gap not only mitigates downside risk but also positions the portfolio to benefit from rental growth as new supply remains constrained.

Capital Markets: Disrupted Flows, Disciplined Positioning

The current capital environment is constrained. For managers with stable investor bases and conservative leverage, today’s scarcity in equity and debt is creating opportunity.

Highlights from the Discussion

Investment capital has become selective and less abundant.

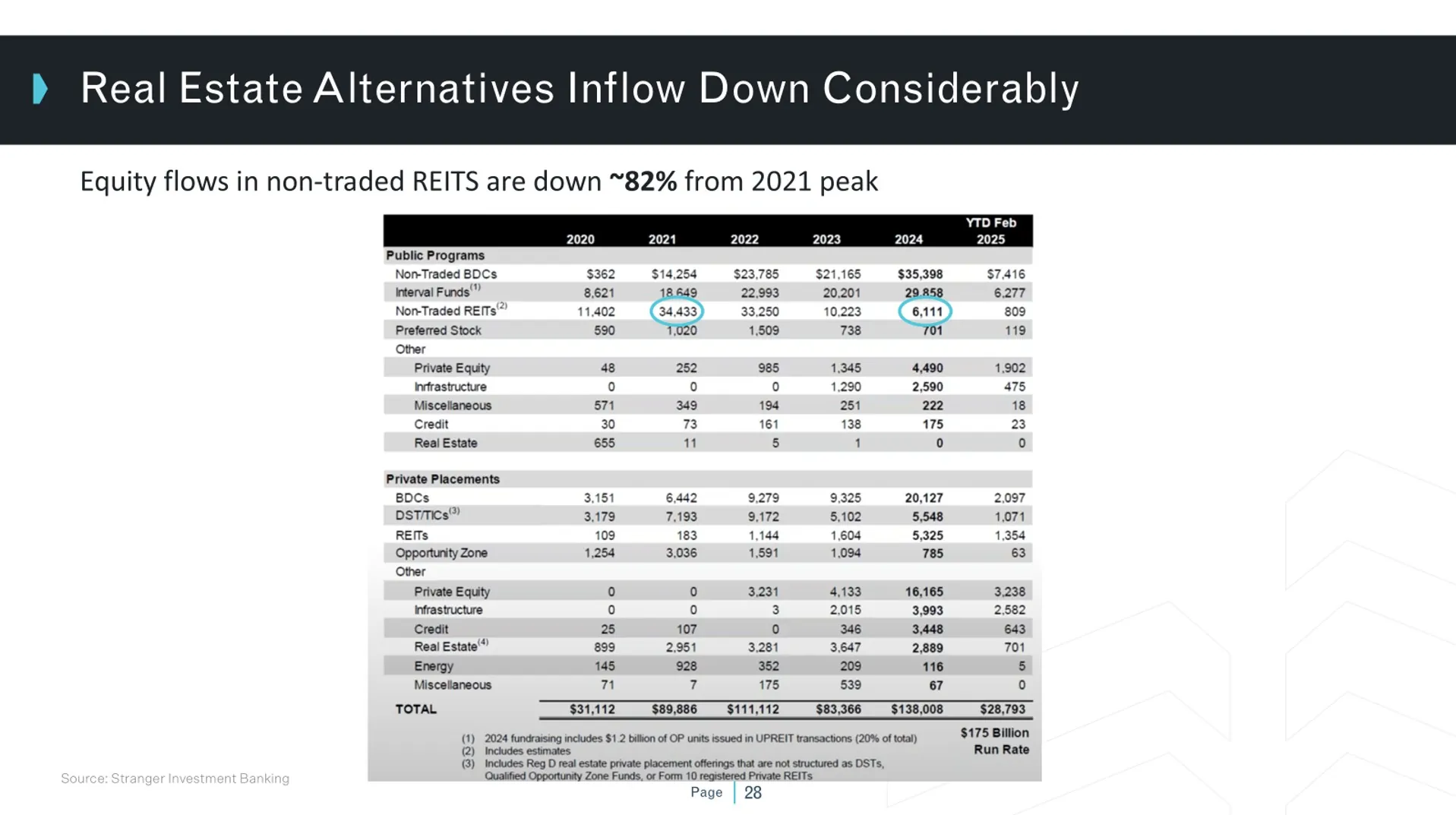

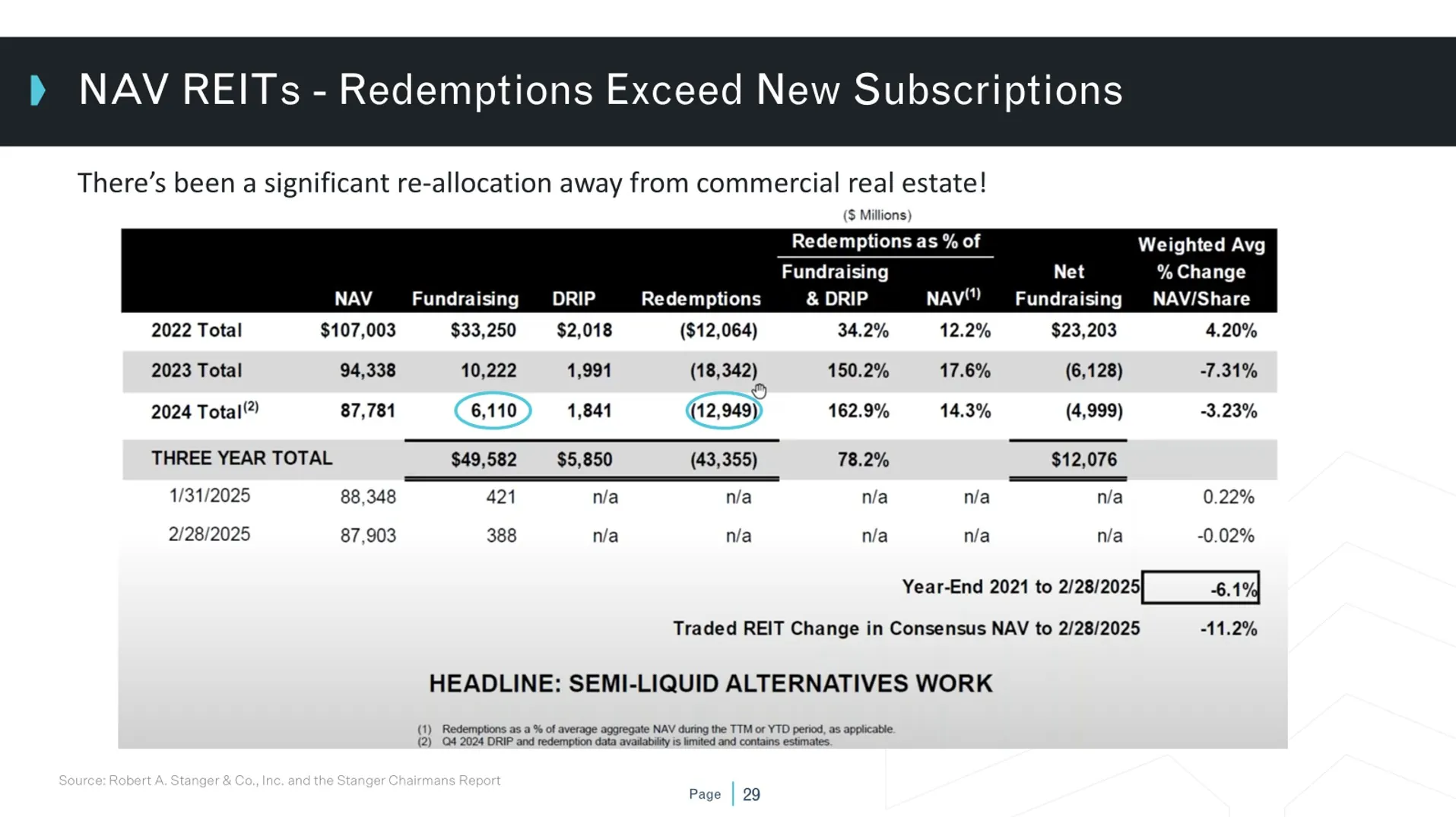

According to a recent Stanger Investment Banking report, In 2021, non-traded REITs raised more than $34 billion. By 2024, that figure had dropped to just over $6 billion, an 80%+ decline. Moreover, major NAV REITs have experienced redemptions in excess of new capital raised for the past two years, forcing many institutional managers into net-seller positions. This dynamic has softened pricing, reduced competition, and created an opening for well-capitalized acquirers. Reduced buyer competition is enhancing our sourcing environment. With many syndicated buyers sidelined and institutions cautious, we are seeing increased access to off-market recapitalizations, developer exits, and transitional assets, all in sectors and geographies aligned with our long-term strategy.

Private credit and fixed income have temporarily diverted capital from real estate.

With risk-free rates in the 4–5%+ range, many investors have shifted away from private real estate and into public and private fixed-income strategies. MLG believes there is potential for meaningful capital to come back to market, which would likely drive appreciation in asset value beyond what we’ve underwritten.

Debt remains available but underwriting is stricter and leverage is lower.

MLG continues to operate with our historic focus of low-to-moderate leverage (typically 60–65% loan-to-cost), which aligns well with the current lending environment. Banks, life companies, and the agencies (Fannie Mae and Freddie Mac) remain active at this level. Higher-leverage strategies, often used by syndicators and merchant developers, have become difficult to execute—removing a significant portion of the buyer pool from active competition.

Conclusion: Investing with Conviction Through Dislocation

Periods of market dislocation often feel uncertain, but for experienced managers with long-term orientation, they can be among the most attractive windows to deploy capital. Today’s private real estate market reflects exactly that dynamic: a convergence of soft near-term fundamentals, reduced capital competition, and mounting barriers to future supply.

At MLG Capital, we are focusing on acquiring quality assets below replacement cost where we expect operational income will increase and valuations to increase, especially if more capital comes back to the space.

We’ve invested across interest rate cycles, recessionary periods, and capital market shifts for nearly four decades. That experience informs a simple but powerful belief: timing markets is elusive, executing our disciplined acquisitions and management strategies across market cycles should result in long-term value for our clients.

For investors seeking tax-advantaged income, portfolio diversification, and a proven, cycle-tested approach to private real estate, we believe now is a moment that matters.

- Watch the Full Market View 2025 Discussion

- Download the Full Market Metrics Deck

- Open Offering: MLG Private Fund VII

FAQ: MLG Capital’s Q2 2025 Market Outlook

What market conditions shaped MLG Capital’s Q2 2025 outlook?

MLG Capital’s Q2 2025 outlook reflects ongoing economic uncertainty, interest rate dynamics, and their impact on real estate fundamentals such as pricing, financing, and transaction activity.

How is MLG Capital viewing private real estate opportunities in the current market?

MLG continues to focus on disciplined, long-term private real estate strategies, emphasizing fundamentals, selective acquisitions, and risk management amid changing market conditions.

What role does interest rate policy play in MLG’s outlook?

Interest rates remain a key factor influencing valuations, capital availability, and investment decisions, and MLG closely monitors policy developments when evaluating opportunities.

What is MLG Capital’s overall perspective for the remainder of 2025?

MLG maintains a measured outlook, balancing caution with preparedness to act on opportunities as market conditions evolve and fundamentals realign.

Securities offered through North Capital Private Securities, Member FINRA/SIPC. Its Form CRS may be found here and its BrokerCheck profile may be found here. NCPS does not make investment recommendations and no communication, through this website or in any other medium, should be construed as a recommendation for any security offered on or off this investment platform.

This article is intended solely for accredited investors. Investments in private offerings are speculative, illiquid, and may result in a complete loss of capital. Past performance is not indicative of future results. Prospective investors should conduct their own due diligence and are encouraged to consult with a financial advisor, attorney, accountant, and any other professional that can help them to understand and assess the risks associated with any investment opportunity.

This offering includes risks and uncertainty many of which are not outlined herein including, without limitation, risks involved in the real estate industry such as market, operational, interest rate, occupancy, inflationary, natural disasters, capitalization rate, regulatory, tax and other risks which may or may not be able to be identified at this time and may result in actual results differing from expected.

Advisory services offered through MLG Fund Manager LLC, an investment adviser registered with U.S. Securities & Exchange Commission.