The historic allure of alternative investments piques the interest of many investors who are constantly seeking diversification in their overall portfolios. In private real estate, there are a variety of options to consider, but the nuances of each asset type can make it difficult to digest and the considerations for every individual investor vary: Why invest in private real estate? Is there a liquidity option? Am I diversified? What type of ongoing distribution and appreciation occur? What are my tax implications? How do I get involved?

As with any investment, each choice has its own unique set of considerations you should review with your advisor team.

Here’s a summary of the most common ways to make an allocation into private real estate.

Public REITS

Real estate investment trusts, better known as REITs, are generally publicly traded investments that own income-producing real estate. REITs were created in the 1960s to give individual investors a vehicle like mutual funds in which they could invest in commercial properties.

As with each differing investment vehicle, there are advantages and disadvantages to investing in a REIT. These investments tend to be liquid – meaning they’re more readily available to non-accredited investors, and investors can divest and sell shares in a REIT at any time.

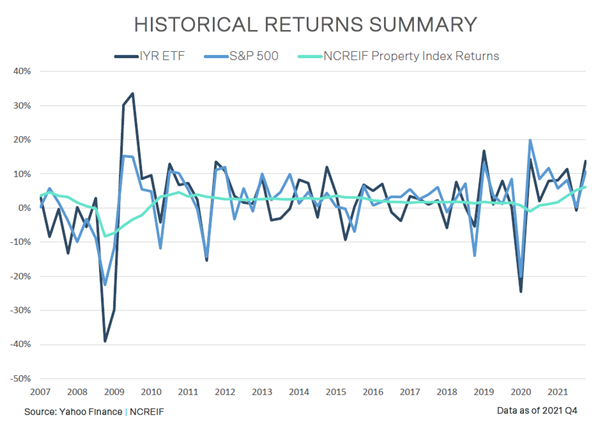

On the other side, however, public REITs don’t necessarily have as many tax advantages as other real estate investment vehicles. REITs also tend to be influenced by the trends in the overall public markets. Market perception can influence the value at which a REIT may trade, even if the actual value of the asset represented hasn’t changed. This can make for an unpredictable, volatile or even a risky exit when an investor wants to divest from the REIT. The below graph reveals the correlation of REITs (IYR, ETF of REITs) to the S&P 500 (broad public market).

(The S&P 500 is the leading indicator of US Large Cap Equities. **The IYR ETF seeks to track the investment results of the Dow Jones US Real Estate Index, which measures the performance of the publicly traded real estate sector of the US equity market. ***NCREIF Property Index is a quarterly measure of the unleveraged composite total return for private commercial real estate properties held for investment purposes only.)

Institutional Real Estate

Institutional real estate, or institutional-grade property, is real estate that meets the size and stature requirements of institutional investors.

The largest private equity real estate investment firms focus on institutional-grade properties, and are typically investing with money from pension funds, insurance companies or large endowments. These types of investments are typically core properties in primary markets (top-tier real estate markets such as the New York metro area, the San Francisco Bay area, and the Washington, DC metropolitan area, for example).

Institutional real estate could have lower overall returns compared to small to mid-cap real estate investments. The lower returns can be a function of the lower amount of leverage used, as well as the cash flow generated during the hold of the asset, in typically higher priced assets (transactions can be multi-hundred-million-dollar deals). The difference in return targets is also a function of the significant amount of capital that must be placed into these assets.

Minimums can vary, but $5 million or more is typically the minimum for investors to enter these types of opportunities and are generally limited to institutional allocators of capital. For the average investor, gaining access to these types of opportunities are rare and unlikely.

Direct Ownership

It’s possible to go to a market and buy your own assets. When doing so, here are some things to consider:

First, you’re invested in one specific deal and, therefore, have a larger percentage of ownership (if not sole ownership) in the property. For some investors, it can be appealing to have direct ownership of the property and to maintain an active position in real estate investing. However, the tradeoff comes when we talk about the benefits of diversification and, in this type of investment, you are not necessarily diversified. So, in the case where factors of the investment are impacted, your entire financial commitment in this asset will be as well. Additionally, your investment is limited to the market in which the property is located. This can also present a greater level of risk, as compared to a REIT or real estate fund structure.

Secondly, you are the manager of that property, unless you outsource to a property manager. In any case, the investor must take an active approach to maintaining the property while it’s being held.

If you are considering direct ownership as an investment opportunity, here are some additional thoughts about how to look for the right deal for your portfolio.

Small to Mid-Cap (What We Do at MLG)

While institutional real estate can focus on a “core strategy,” by purchasing prominent properties using lower levels of leverage, small to mid-cap real estate investing includes greater use of value-add and opportunistic real estate strategies. These investments are generally “below” institutional-grade quality, but the strategies in this space can provide a unique advantage for your investment portfolio.

An example of the value-add strategy is purchasing an apartment complex where rents are lower than comparable properties in the area. Taking an active approach to increase the value of the property, a value-add investment might involve renovating the property or other activities permitting rents to be materially increased. The increase in rental income increases the cash flow of the asset and improves the asset’s valuation. After several holding years (where cash flow is maximized and generated), the property is sold, presumably with an appreciated asset value due to the higher cash flow. Camelback Flats is a great example of this strategy in action.

Opportunistic investments can come with higher risk than value-add but may offer higher targeted returns. An example of an opportunistic real estate play is the purchase of a property, such as an office or retail building, and converting the asset into a different use, perhaps a multi-family property or hotel, or correcting an issue at the asset such as low occupancy.

Generally, investors can enter at a lower investment minimum (usually ±$100,000-250,000+) and can obtain substantial geographic and asset class diversification with those dollars. Especially, in a preferred investment structure like a fund.

A preferred investment structure, where passive investors accrue a preferred return before the investment manager is entitled to profit participation, is imperative to mitigate the risk and enable you to hit your targeted return. My colleague, Jorjio Hopkins has thoughts on why the European equity waterfall structure should be the new normal.

Summary

There’s no one-size-fits-all when it comes to investing in private real estate and each investor should review each of opportunity as it relates to his or her overall portfolio and objectives. In most cases, private real estate is illiquid, and the success of your investment hinges on the expertise and active involvement of your investment manager to a greater degree than other types of real estate investments. Having a trusted and experienced manager is important to help you wade through what assumptions are real, and what aren’t. Lots of real estate deals can look good on paper, or online, but focusing on smart investments with believable and achievable assumptions is key. It takes an experienced eye with extensive real-life experience in the space to best assess which deals will most likely meet expectations.

MLG Capital focuses on assets with purchase price of $5-85MM+, which compared to public REITs and institutional investments, is usually a more fractured and fragmented industry. There are attractive investment opportunities and human error that occurs readily within the space. At MLG Capital, our job is to find opportunities in these mistakes, lean on our 3 decades of market knowledge, relationship and technology and correct them in order to create value for our investors. Start your real estate investment journey with us today.

David Binder is Senior Vice President at MLG Capital. David focuses on operations primarily within the investor operations, capital sourcing, corporate data/technologies and company marketing realms, related to corporate objectives. He joined MLG in 2014 to help the company launch its Fund series and previously held various positions with Wells Fargo, Wells Fargo Advantage Funds and a correspondent lending company. He has a bachelor’s degree in marketing with an emphasis on real estate. He is passionate about always digging deeper by asking “Why?”, seeing folks succeed in life and surrounding himself with those that are (much) smarter than him.